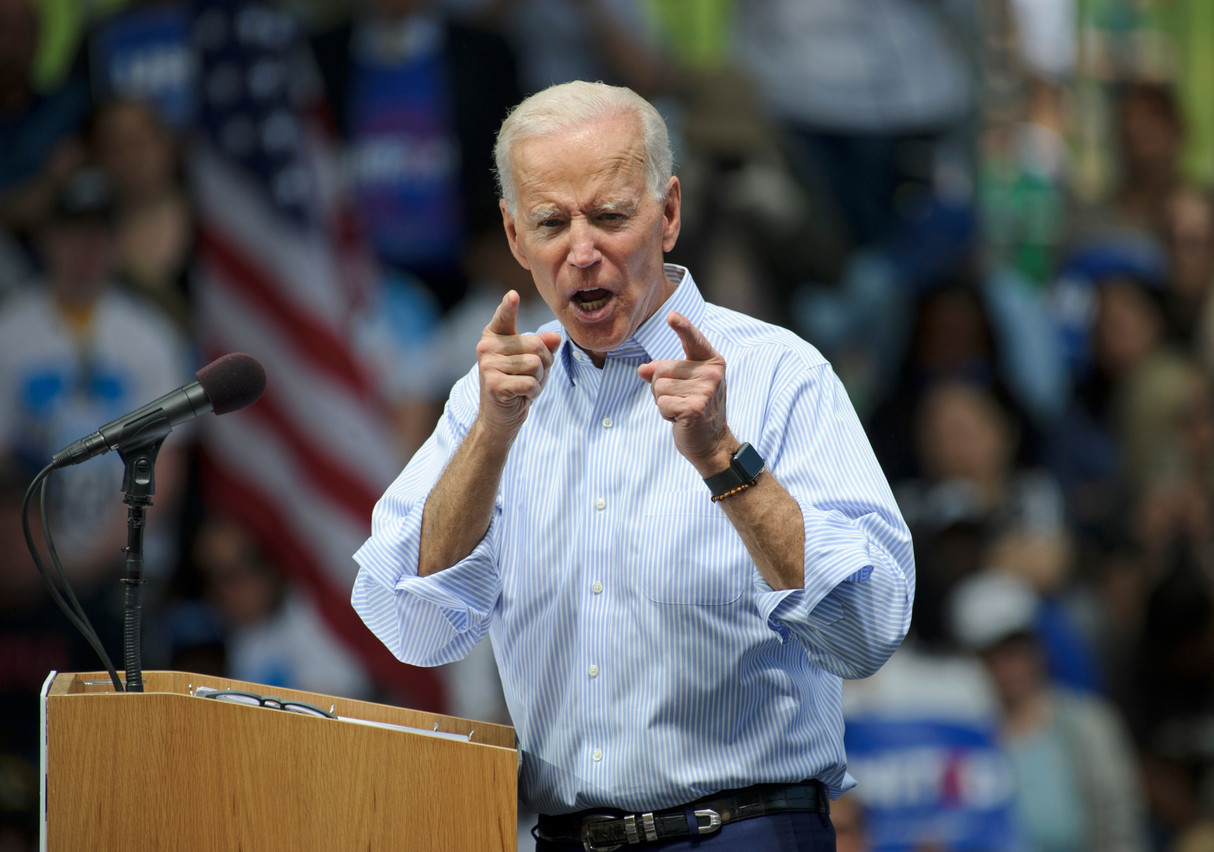

Luxembourg-based Quintet Private Bank has teamed up with Dutch bank Robeco in a strategy based on green dollar bonds. Following President Joe Biden's priorities in the fight against global warming, they believe that we should see a boom in green bonds in dollars.

The Dutch bank has therefore created RobecoSAM US Green Bonds, which offers diversified exposure to the US green bond market. The goal is to "promote a positive environmental impact while aiming to generate long-term capital gains above the Bloomberg Barclays MSCI USD Green Bond Index", the two partners explain in a press release.

In this collaboration, Quintet will be an exclusive partner within six months of the launch. The Luxembourg bank has targeted an initial commitment of €125 million. The dollar-denominated green bonds will be deployed in Quintet's discretionary portfolios as part of its "sustainable by default" strategy.

Why focus on US bonds? Because while Europe currently dominates the global green bond market with 60% of the world's issuance volume, "the U.S. now seems determined to close that gap," they explain.

They expect dollar-denominated green bond issuance to explode. This year, it is expected to smash the $95 billion record reported for the year 2020, following a first half-year interim balance sheet of $65 billion.

This article in Paperjam. It has been translated and edited for Delano.