With 58% of the world’s aluminium production, 88% of magnesium production, 70% of silicon production, 58% of tellurium production, 36% of titanium production and 38% of copper refining, there are 152 references to China in the latest report from the US Department of Energy (DoE), . 152 references that underline the economic reality that awaits us.

For example, 60% of the new electric vehicles put on the market in 2022 will be produced in China. Or the fact that China is likely to curb its aluminium production because of the energy cost of this rare material.

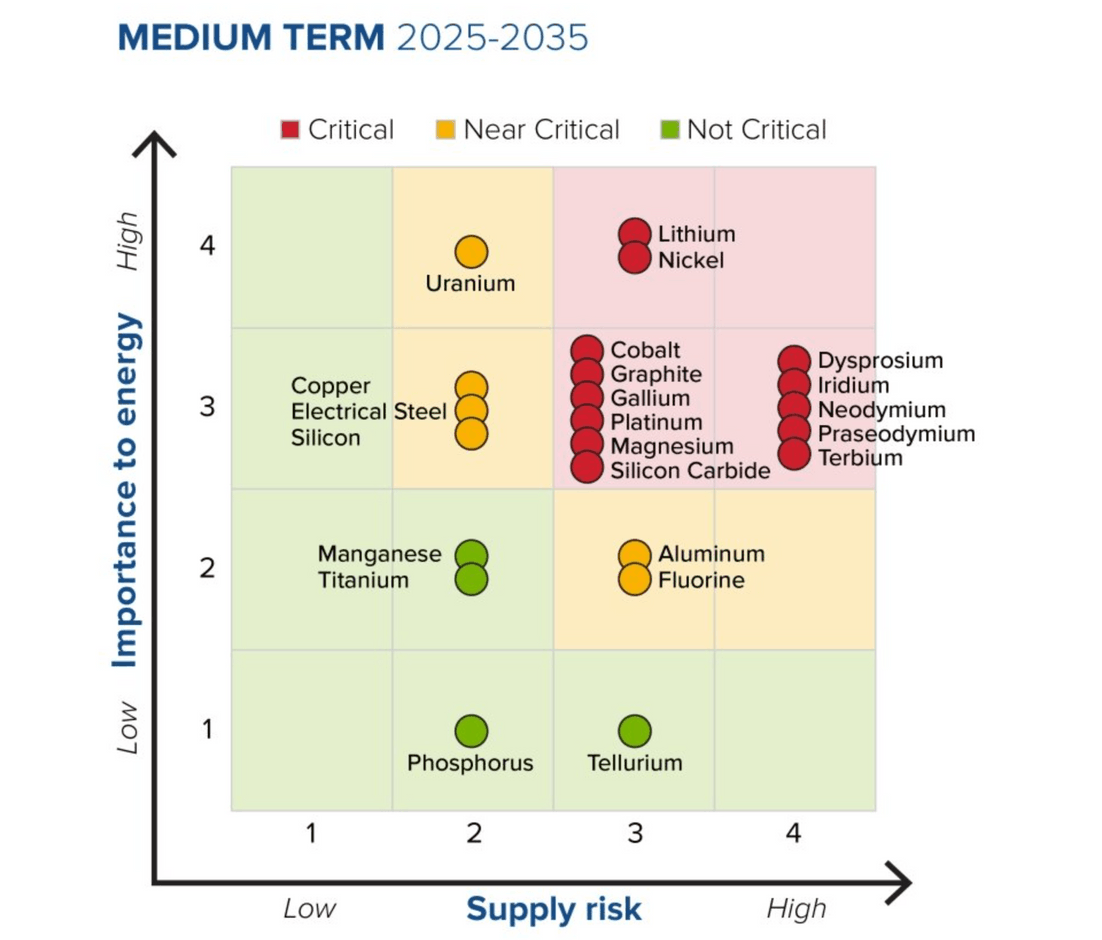

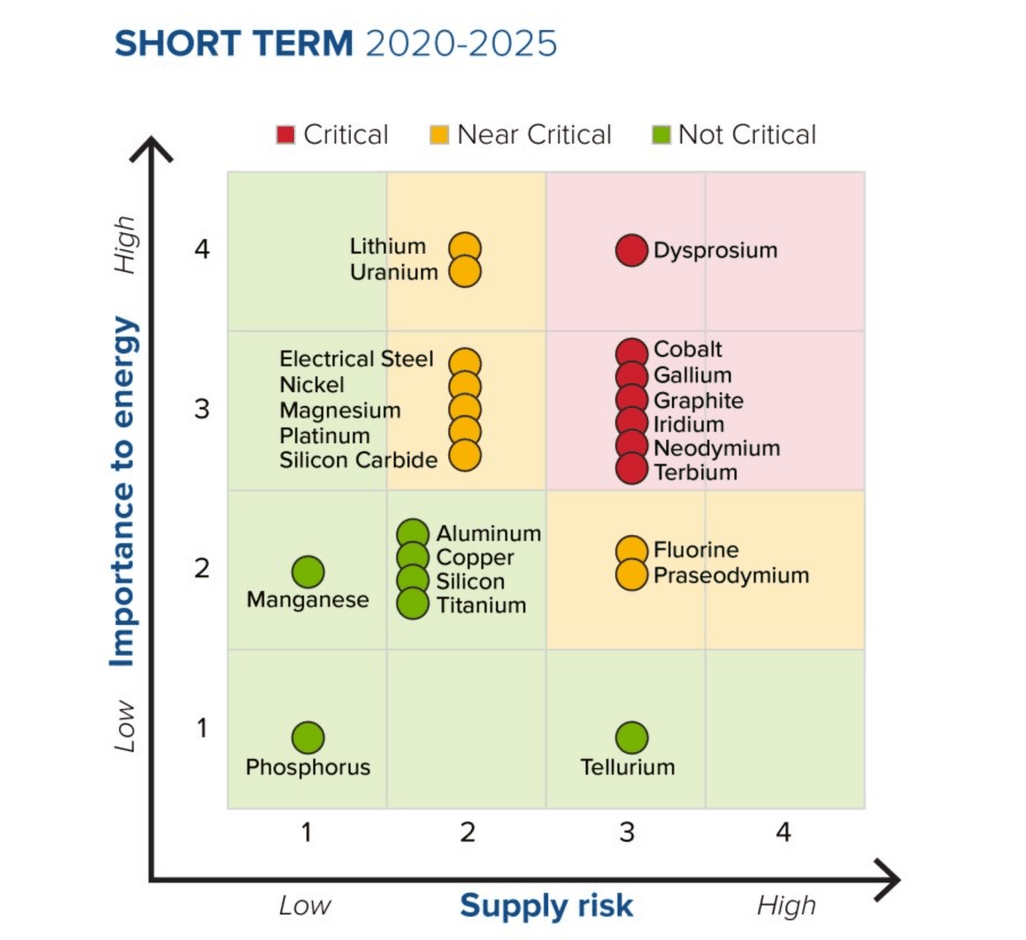

In its updated list, the DoE includes:

- energy-critical materials: aluminium, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, silicon, silicon carbide and terbium.

- the 50 critical minerals: aluminium, antimony, arsenic, barite, beryllium, bismuth, cerium, caesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium, zinc and zirconium.

In 2021, on the list of 17 rare materials, China was capable of producing 44m tonnes out of the total global output of 116m tonnes, ahead of Vietnam (22) and Brazil (15).

“As our nation continues the transition to a clean energy economy, it is our responsibility to anticipate the critical materials supply chains needed to manufacture our most promising clean energy generation, transmission, storage and end-use technologies, including solar panels, wind turbines, power electronics, lighting and electric vehicles,” said DoE office of energy efficiency and renewable energy (EERE) acting assistant secretary Alejandro Moreno. “Ultimately, identifying and mitigating the criticality of materials now will ensure that a clean energy future is possible for decades to come.”

And it’s in the supply or production chain that eyes are increasingly turning.

The value to follow

The only American production site, Mountain Pass, has been awarded a $35m contract as part of the Biden plan to speed up its transformation. This is . And even the recent agreement with Japan’s Sumitomo is not enough to panic the middle kingdom: China is due to build a national technological innovation centre for new rare earth materials in Baotou, in the autonomous region of Inner Mongolia (northern China), which is home to the world’s largest reserve of rare earths, reports the Global Times, which points out that the Chinese authorities have already invested $2bn in this plan in 2021. The developments of MP Materials Corp, which manages Mountain Pass, are to be followed.

This story was first published in French on . It has been translated and edited for Delano. This article is not intended as investment advice. Be sure to carefully investigate any company mentioned in the press before taking an investment decision.