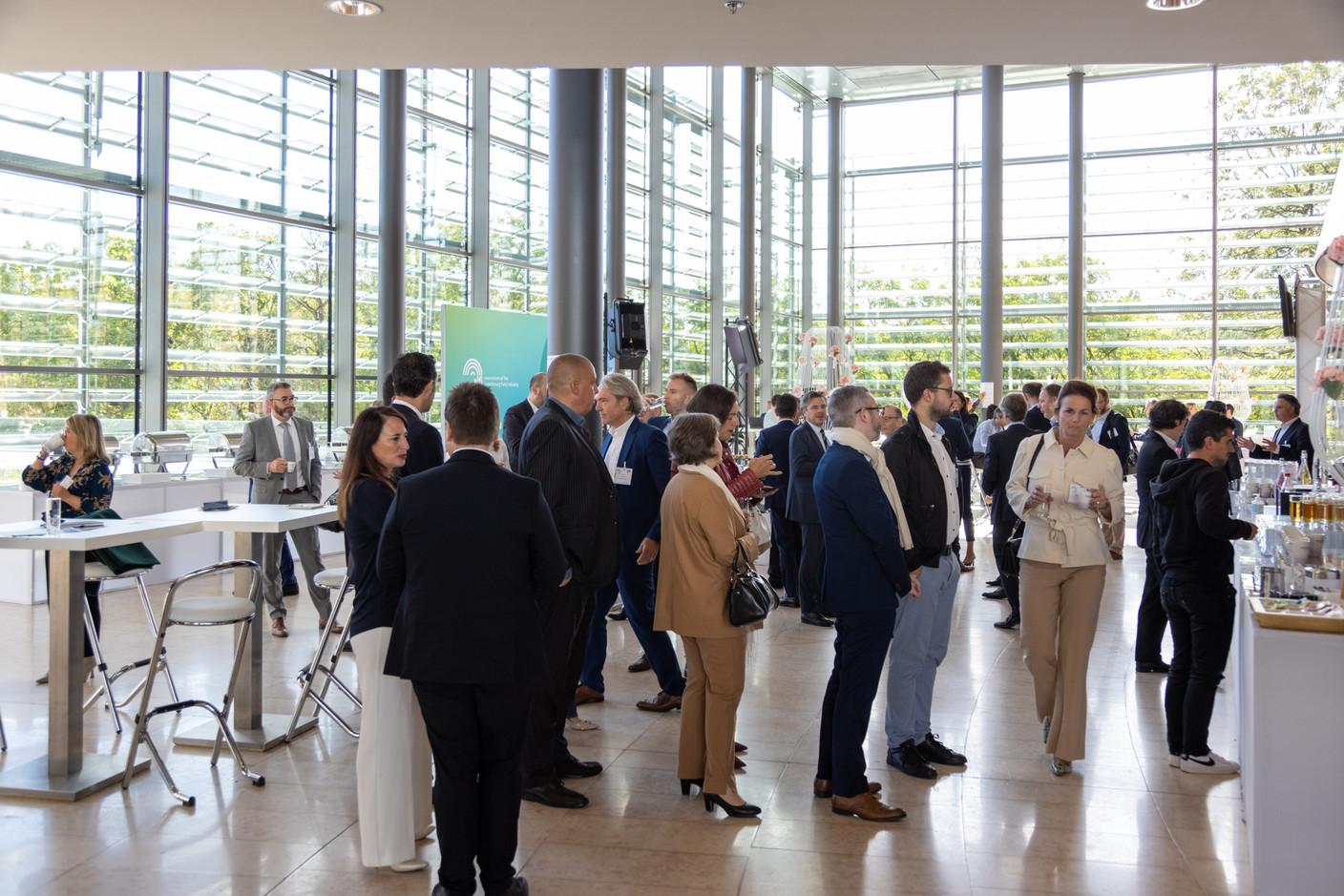

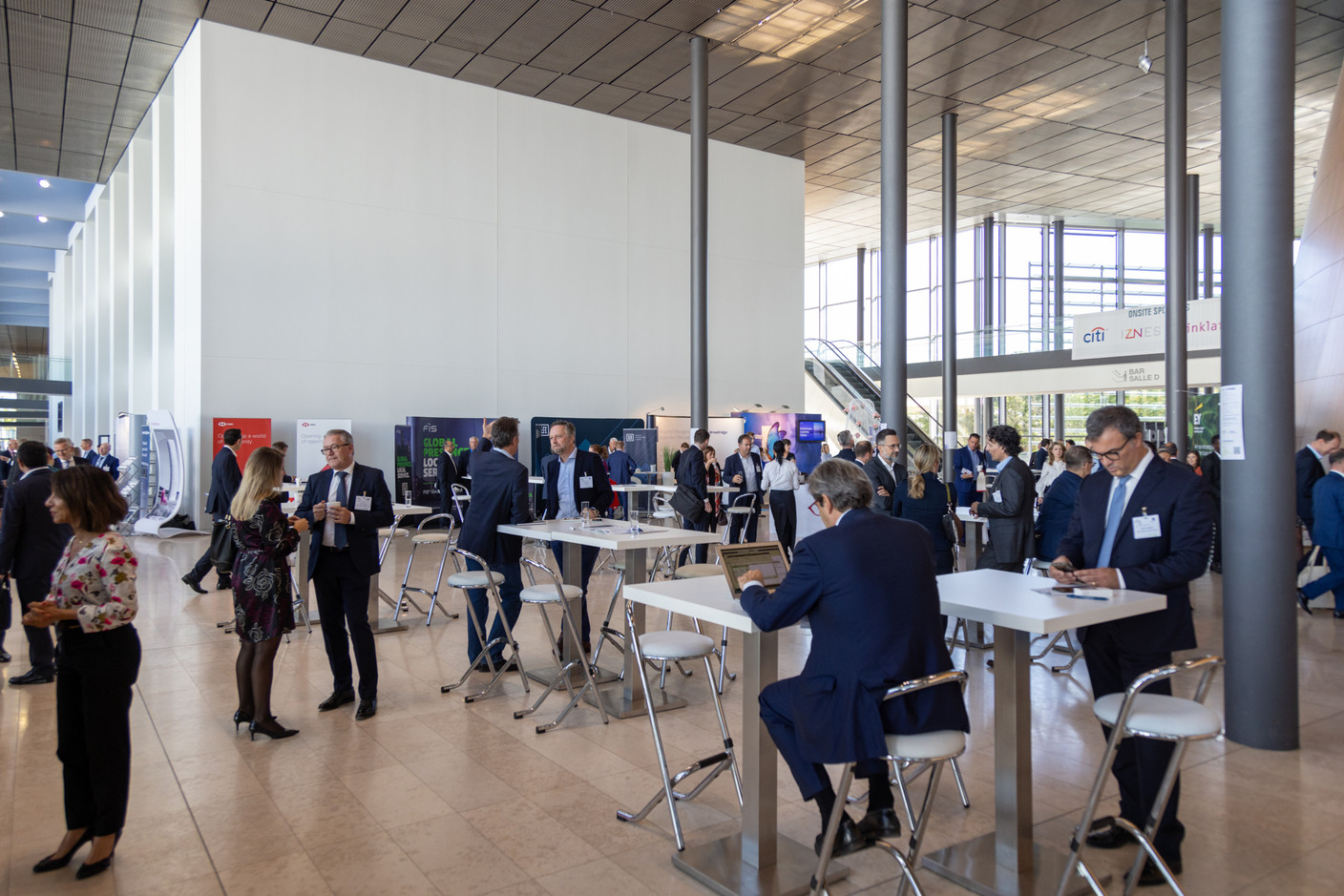

The second day of the Association of the Luxembourg Fund Industry’s Global Distribution Conference a presentation on investor flows, a panel on how can expand the retail investor base in a cost-effective manner, a look at Millennial and Gen Z investment preferences, and panels on the Middle East, Latin America and Europe regional markets.

In his opening remarks, , Alfi’s director general, said it was interesting to see which challenges are similar and which ones are unique around the world.

Jon Snow on the cost of living and climate change

A keynote speech was delivered by the well-known British journalist Jon Snow, who presented Channel 4 News from 1989 to 2021. Snow said he could not remember such “gloomy assessments” of the coming year. Referring to the rising cost of living and gas crisis, he pointedly told bosses that they should be protecting their workforce, “even if that dents profits.”

Read also

After lengthy comments on populism and Brexit, he turned to climate change. He encouraged younger people to get involved, to take charge of the crisis and to lead “old farts” like him who want to provide support. But the younger generation needed to be in front. Snow said that he remained optimistic that the planet was collectively up to the challenge. “Climate change will demand sacrifice” and plenty of investment, he concluded, so “let’s go for it!”

Investment flows

Liam Martin, director of global insights at Broadridge, a financial data and technology provider, illustrated how interest rates and inflation have influenced European investors and will continue to do so. His presentation pulled from a Broadridge commissioned by Alfi and released during the conference.

Martin later said that fund selectors wanted better transparency and reporting, rather than product innovation. He also said the ESG segment was holding up well this year, despite dour fund flows overall. ESG and responsible investments have been growing faster than other segments since Q4 of 2019, he stated.