In fact, they might just matter more than ever, as Capital Group vice chair and president Rob Lovelace asserts in this wide-ranging Q&A. The bull market may be long in the tooth and overdue for a correction, he explains, but there’s a reason the pandemic couldn’t bring it down.

What’s your outlook for global equity markets as we embark on a new year?

There’s a three-part framework I like to use and that is: pandemic, economy, markets. The pandemic is going to be with us for a while, but it will have a diminishing impact on the economy over time. That’s the pattern we’ve seen. And the health of the economy matters a lot to the bond market, but less so to the equity markets. The stock market is driven by the earnings of the companies that are listed, and many companies have done well even during the COVID period. So we should see the pandemic having less impact on the economy, the economy continuing to expand and companies well positioned to thrive.

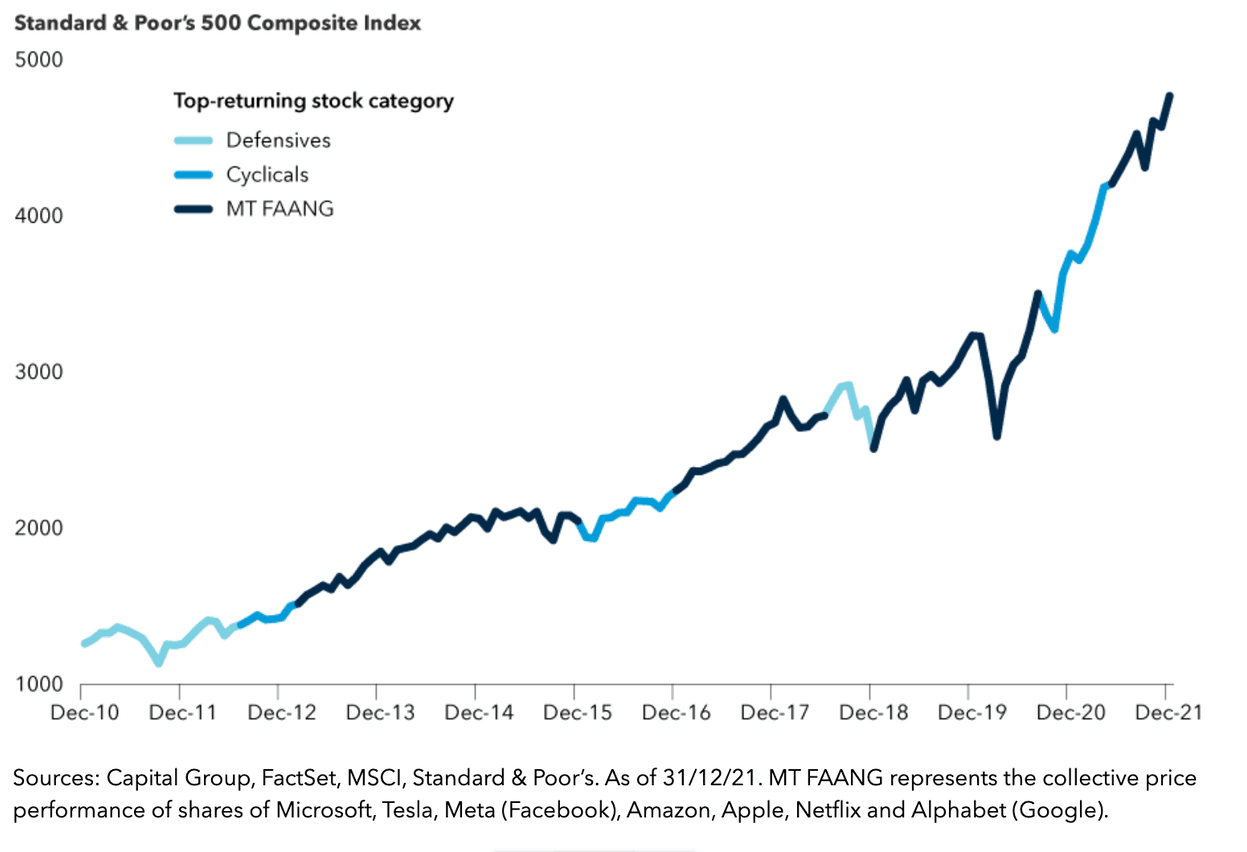

After the COVID correction in the first quarter of 2020, stocks not only bounced back, they continued the extension of what we now realize is a decade-long bull market. It's been led by the same group of U.S. tech-related stocks that we used to call the FAANGs — Facebook (now Meta), Amazon, Apple, Netflix and Google (now Alphabet). That long-term trend is still in place. COVID interrupted the climb, but it didn’t change the fundamental direction of the markets.

Pandemic-era rally is a continuation of a long bull market

Pandemic-era rally is a continuation of a long bull market Capital Group, FactSet, MSCI, Standard & Poor’s

Interested in finding out more?