SES has taken the "recommendations" of US activist fund Appaloosa very seriously. In a press release, the world leader in satellite communications with sales in excess of €2bn, says it has appointed two new directors:

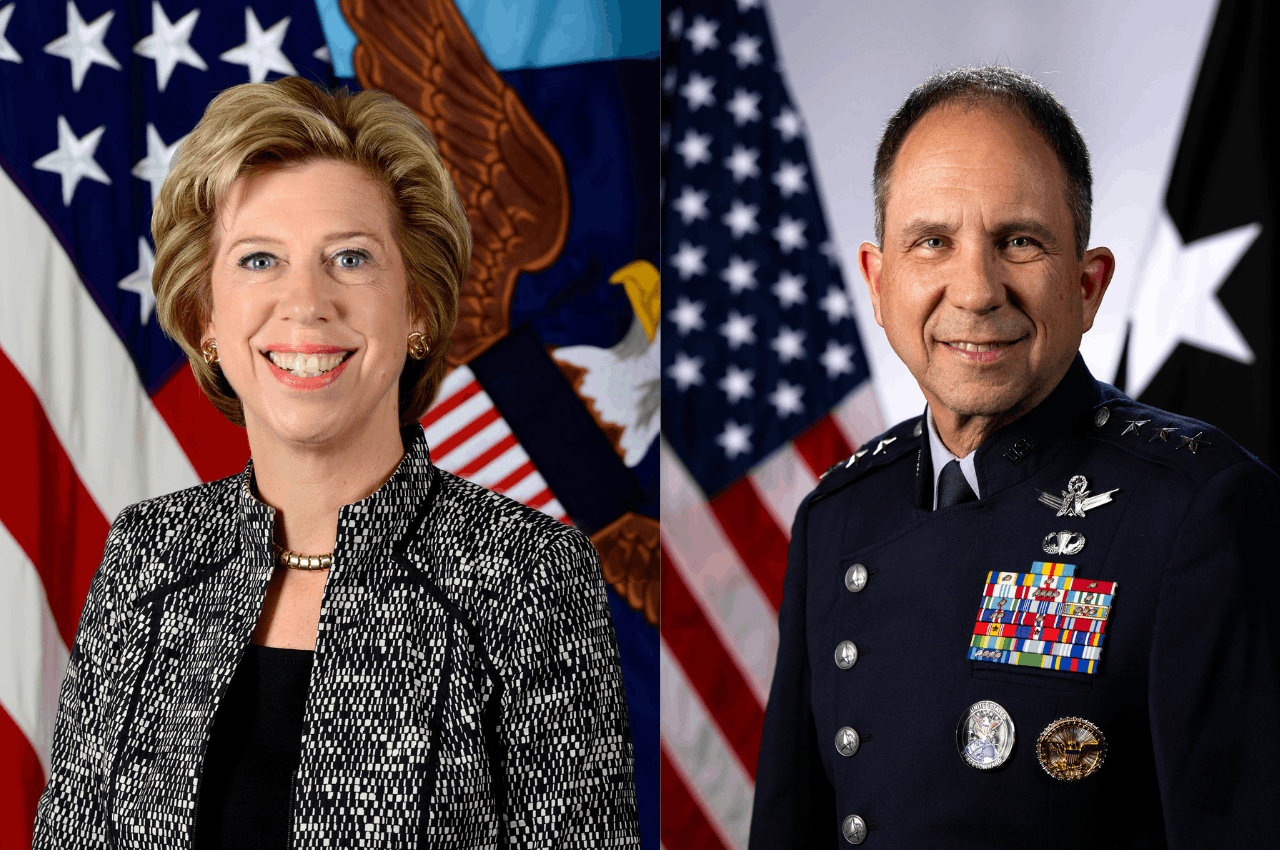

- Ellen Lord, former US Under Secretary of Defense for acquisitions and sustainment at the US Department of Defense and who has board experience with listed and unlisted companies, including Voyager Space Holdings Inc., the National Defense Industrial Association and the Defense Technology Initiative.

- John Shaw, former Deputy Commander, US Space Force and the first Commander, USSF Space Operations Command and Combined Forces Space Component Command.

A double "recruitment" to which will be added, just before or just after the 2026 AGM, that of a new director, "adding further expertise in capital markets". At that time, the board of directors will be reduced from 11 to 9 members. Two of the points demanded by the US fund, which, according to our calculations, holds around $145m worth of SES shares (7%).

No change to the dividend or structure

No change for the time being, however, to the dividend that SES pays to its shareholders. "Resolution 21 is unnecessary and is intended to deprive the company's board and management of the essential flexibility to manage the company's business and liquidity in the best interests of the company, its shareholders and other stakeholders," says the response, which adds that the dividend will be increased as soon as it achieves its net leverage target (adjusted net debt to adjusted Ebitda) of less than three times within 12 to 18 months after the closing of the Intelsat transaction. It also says that since 2021, the total shareholder return is €1.2bn, or "more than 100% of its adjusted free cash flow over the same period".

SES also analyses Appaloosa's request as an idea that "prioritises increasing shareholder remuneration in the short term and ignores the need for the board to be agile in responding to an ever-changing macroeconomic and competitive environment, which could jeopardise the company's trajectory and future long-term growth. Our strategy balances strategic investment, expected to drive long-term growth and generate sustainable cash flows, in line with our established 10% IRR threshold, with an approach to shareholder remuneration that meets the company's capital allocation priorities."

No question either of changing the capital structure by reducing the weight of the Luxembourg state's shareholding, known to investors before they decided to invest in the company, a shareholding that is indeed present on the board but which cannot "dictate strategy" and does not hinder "management's ability to implement SES's profitable growth strategy".

Shares trending lower, a sign of Appaloosa's loneliness

Calmed Appaloosa (1bn in Alibaba, 570m in Amazon or 519 in Pindoduo, for example)? No, not really. The fund reacted immediately, in a second press release. While it welcomes the fact that "the first steps taken by the SES Board to modernise its structure are long overdue and were only taken following pressure from shareholders", it points out that "much more can and must be done, and with a greater sense of urgency than that revealed by the Board's incrementalism. Specifically, the addition of a director with capital markets experience should be a priority, as we believe that such an appointment could prompt SES to finally begin to address its poor capital investment practices and return value to shareholders. Equally, the other Board, capital structure and governance measures outlined in our proposed resolutions are no less urgent. Shareholders should be disappointed that the Board has not even authorised a vote on our proposals relating to capital structure and governance."

By midday on Wednesday, the share price was down to €5.39, which seems to indicate that the market has fully understood the firmness of the company and the prime minister, (CSV), on Tuesday afternoon in the Chamber of Deputies, questioned by former economy minister, (LSAP).

On 2 April in Betzdorf, in addition to the double appointment, the general meeting will also have to renew the mandates of Peter Van Bommel (Vice-Chairman), and . Four other terms of office are up for renewal next year, including that of Chairman Frank Esser (plus Kaj-Erik Relander, Jacques Thill and Anne-Catherine Ries), at a time when the number of directors is set to fall from 11 to 9, with the two Americans of symbolic importance to SES's development, especially in its government focus.

This article was originally published in .