Société Générale, France’s third largest listed bank and a major employer in the grand duchy, posted better-than-expected second quarter loss, despite taking a multi-billion-euro hit on the sale of its businesses in Russia.

Socgen sold Rosbank and its Russian insurance subsidiaries on 18 May, resulting in a pre-tax loss of €3.3bn.

However, net banking income was higher than expected. It was up by 13% year-on-year. That narrowed the quarterly loss to €1.48bn, the bank on 3 August.

Analysts had expected it to post a €2bn loss, Reuters .

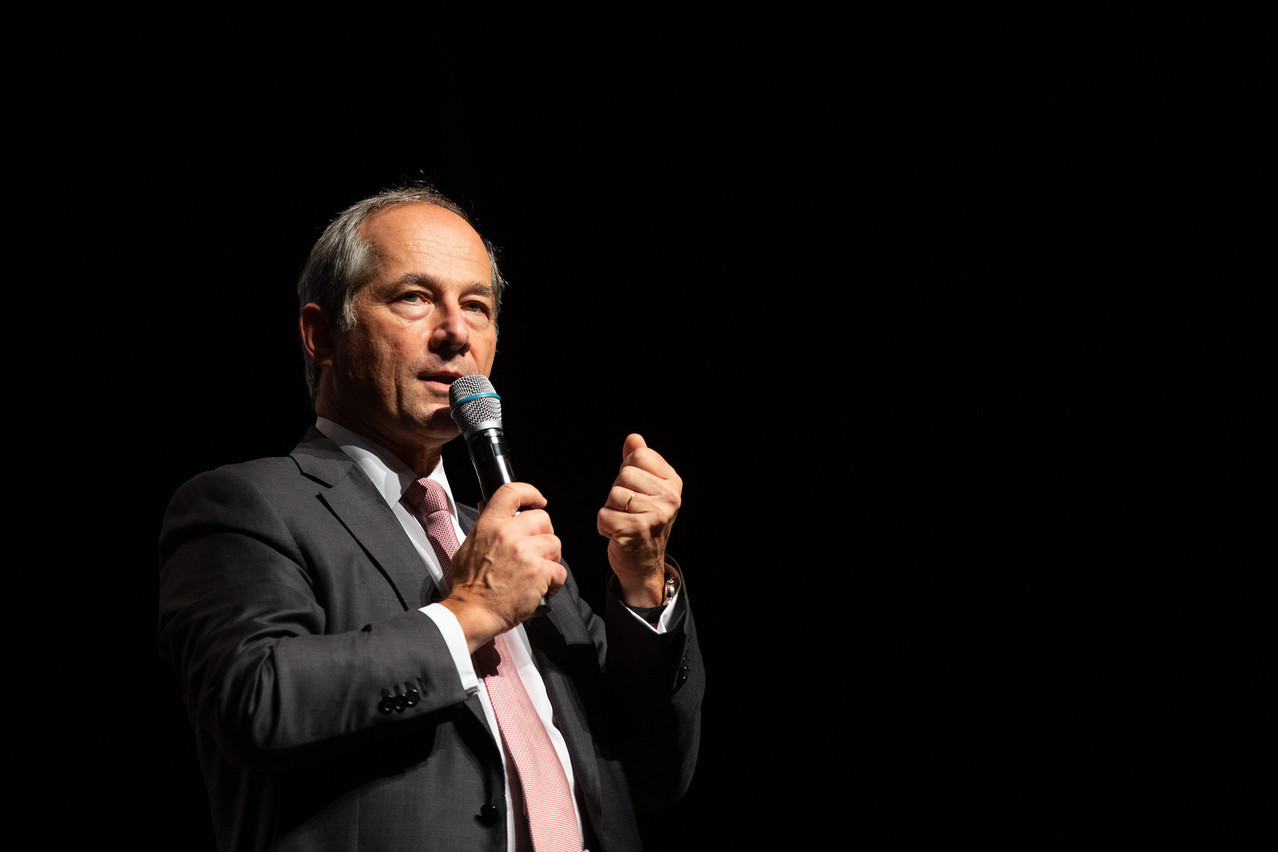

Fréderic Oudéa, the banking group’s CEO, said in its announcement that “we were able to manage our exit from the Russian activities without significant capital impact and without handicapping the group’s strategic developments.”

Read also

The Société Générale group, including its ALD automotive leasing unit, employed 1,240 staff in Luxembourg at the beginning of the year, according to Statec .

Socgen disposed of the Russian businesses in the wake of EU sanctions against Moscow, which were implemented following Russia’s invasion of Ukraine.