The latest opinion polls are clear: access to affordable housing is . Throughout the grand duchy, but more pronounced in the capital, the prices of apartments and houses for purchase have followed an increasingly steep slope in recent years: +10.1% in 2019, +14.5% in 2020, +13.9% in 2021 and +9.6% in 2022.

“The urgency can be read in the figures,” was concluded organised on 28 March. For the more than 130,000 inhabitants of the capital, for all those who are looking to move closer to their office in Kirchberg or the Cloche d’Or, but also for the tens of thousands of employees--potential residents--that the financial centre (among other sectors of activity) will have to attract in the years to come, the figures summarised below are alarming signals and appeals for real estate tranquillity after years of uncontrollable frenzy. Candidates in the municipal elections (11 June) and the legislative elections (8 October) will have to work to contain them in order to convince their voters.

Buying a flat, a daring gamble

Although a fall in prices was noted at national level , this is not reflected in the annual figures for the price of an apartment in Luxembourg City.

In its latest annual publication on housing prices, Luxembourg’s statistic bureau Statec reported a selling price of €11,071/m2 for an existing apartment in the canton of Luxembourg, and a selling price of €12,804/m2 for a property under construction (VEFA). This is an increase of around 5% compared to the prices observed in 2021.

At the same time, advertised prices have increased by 3.9% (old) and 6.2% (new). However, this is not in line with the figures for previous years (+19.9% and +17.3% for VEFA in 2020 and 2021, for example). This slowdown is a possible sign of a paradigm shift in the months to come, as observed by athome.lu on a national scale in the , for example.

However, the upside is still there. One only needs to look at the 2022 range of prices per m2 to be convinced: between €8,776 and €15,343 for an old apartment; between €10,513 and €17,566 for an apartment under construction. These are record values that are three times higher than those observed 15 years earlier, according to official data.

Unsurprisingly, the most expensive properties on the market in the capital at the end of 2022 were to be found in the posh districts of Belair and Limpertsberg. In these districts, the prices announced last year were close to €15,000/m2. “In some projects or neighbourhoods, we can even exceed €16,000/m2, which is higher than Parisian prices,” emphasises Julien Licheron, research associate, urban development and mobility at Liser.

A neighbourhood-by-neighbourhood focus highlights that those far from the city centre, particularly towards the east, offer lower prices while somehow resisting property inflation over a decade, such as Dommeldange or Cents.

On the other hand, dissecting the evolution of advertised prices reveals some rather edifying figures: +120% increase over the entire territory, +169% in Limpertsberg, +168% in Hollerich or +163% in Kirchberg.

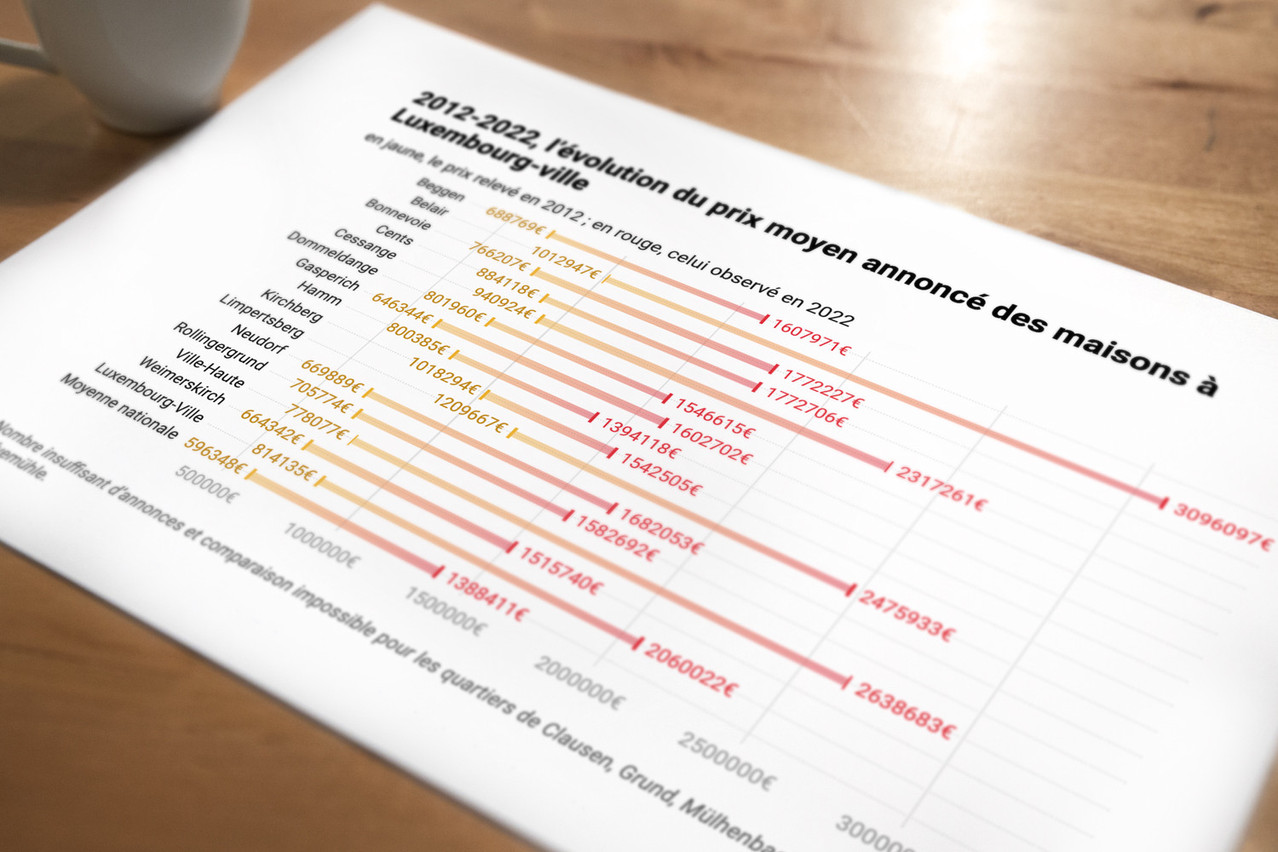

Buying a house, a very expensive privilege

It is not surprising to note that the market for buying houses is much more limited than the market for apartments in Luxembourg City, which in 2022 accounted for 57% of the number of offers of apartments for rent in the country as a whole, 29% of the number of offers of apartments to buy, but only 7% of the number of offers of houses to buy. It has therefore been clear for many years that buying a house in the capital requires significant financial resources that not many have.

In its annual publication on housing prices, Statec reports an average selling price of €1,591,097 in the canton of Luxembourg in 2022 (€1,460,000 for the median price). The average advertised price recorded by the housing observatory is considerably higher: €2,060,022. And the latter is interesting, because it indicates--for the very first time if we rely on the 15 years of data made available by the observatory--that this price is down compared to the previous year (-2.5%).

But this comes after years of crazy, triple-digit inflation, locally over 200% in the last decade.

If we look at the neighbourhoods, it is worth emphasising the obvious disparities that are explained by demography, geography and local buildings. Clausen (1,060 inhabitants and four ads published in 2022), Gare (11,895 inhabitants but three ads), Grund (1,030 inhabitants but one ad), Pfaffenthal (1,303 inhabitants, but nine ads) are all neighbourhoods where the volume of houses is fundamentally rather low, especially in comparison with Belair, Bonnevoie or Cessange, for example.

Renting an apartment is becoming increasingly unattainable

With home ownership requiring more and more financial resources each year, and with property prices soaring and interest rates skyrocketing, for more and more residents. At the national level, the housing observatory has thus observed a more pronounced rise in rents announced in recent months, with the limitations imposed by the sole reading of the property market in the absence of official data: the opacity of the negotiation margins between landlord and tenant, and the possibility that some properties may not find takers, due in particular to prices being too high.

In the capital, the reading of these data shows a discontinuous growth in the cost of rents, with striking inflation peaks of over 17% compared to the previous year in 2018 or 2020. It now costs almost €40/m2 to rent an average property in Luxembourg City (an increase of 107% over 10 years), although, as elsewhere, the situation must be qualified according to the reputation of the districts and the type of property on offer.

“The most prestigious districts, such as Belair, Limpertsberg or the Ville-Haute, are more expensive than districts such as Bonnevoie or even the station area,” Licheron explained when commenting on the figures for the last quarter of 2022 and therefore for the annual report. In this respect, it is interesting to note that the smaller the size of the rented areas, the more the price per m2 may tend to increase. This is a way for the owner to make a profit on his investment in land. For example, Bonnevoie had the highest advertised average rent per m2 (almost €47). However, a few simple calculations show that it is also in the popular Bouneweg district that the average surface area of the rented properties was the lowest: €23.9/m2. These are therefore mostly studios. No property is spared from the boom.

This story was first published in French on . It has been translated and edited for Delano.