Swiss Life Asset Managers has announced the successful completion of the first closing of its Swiss Life Funds (LUX) ESG Global Infrastructure Opportunities Growth II, the second of its value-add infrastructure funds, amassing more than €560m in capital commitments since May 2023. The fund, which is part of the Swiss Life Funds (LUX) Global Infrastructure Opportunities Umbrella, is well on its way to reaching its €1bn target, the firm in a 8 December press release.

Investors are given the opportunity to invest in control and co-control stakes in the growing sector of small to mid-market value-add infrastructure assets, as highlighted in various OECD markets, according to the statement. Swiss Life further added that these investment opportunities are strengthened by key socio-economic trends, including decarbonisation, digitalisation, emerging mobility, evolving logistics, the circular economy and demographic changes.

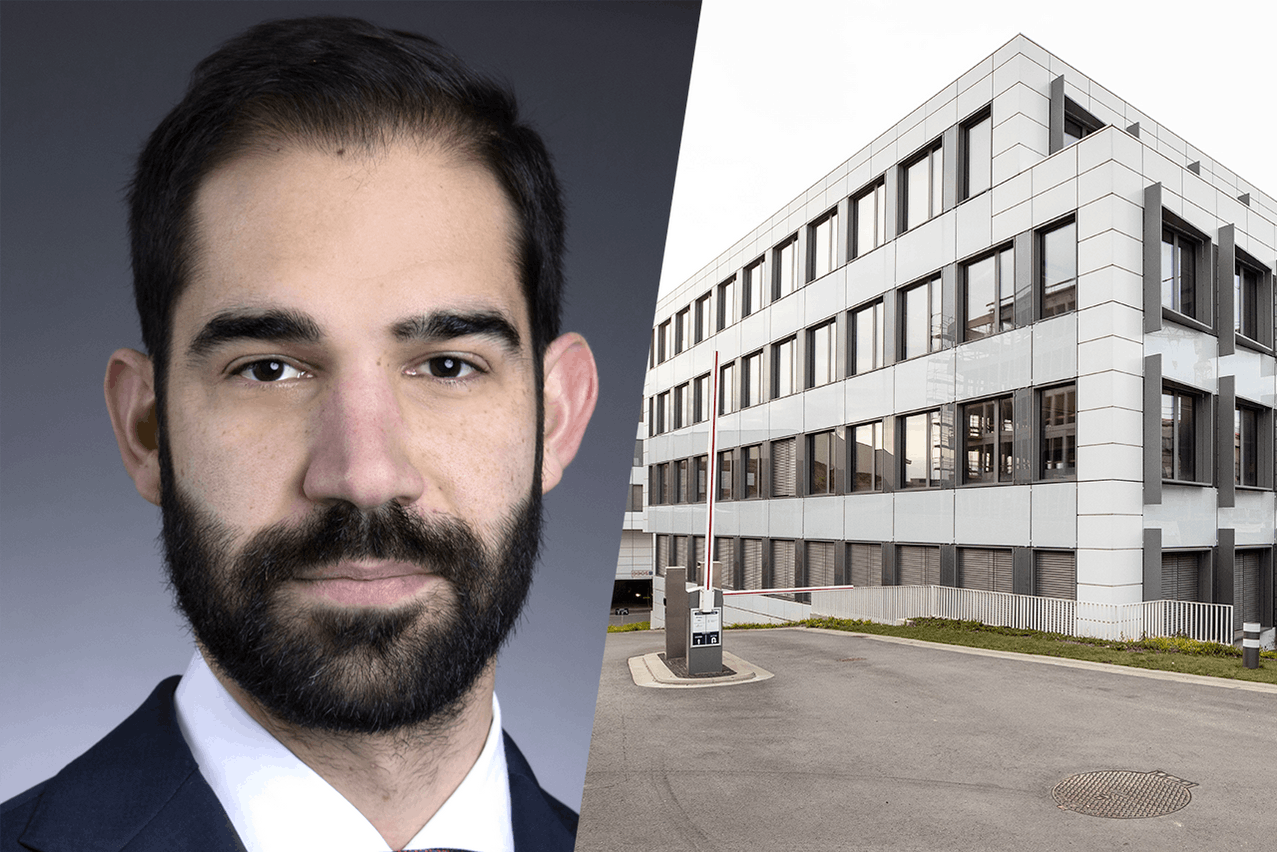

Gianfranco Saladino, the head of value-add investments at Swiss Life Asset Managers, expressed his enthusiasm about the fund’s launch in a market ripe for value-add infrastructure investments in the announcement. He noted the acceleration of key generational trends, which provide substantial investment opportunities, and stressed the importance of active operational and financial management in creating value in portfolio companies.

The fund is categorised as an article 8 fund under the European sustainable finance disclosure regulation.

As of 30 September 2023, Swiss Life Asset Managers managed over €10bn in committed capital globally in the infrastructure sector, with this investment distributed across various funds.