Founded in Switzerland in 2018, and also established in Singapore, Sygnum Bank has placed itself under the authority of the Luxembourg financial regulator, the CSSF, for all matters related to the fight against money laundering and terrorist financing. It’s a new step that should be followed by the establishment of a new branch in Dubai.

With its Swiss banking license and Singapore capital markets services license, this first digital asset bank, now also registered as a “VASP” [virtual asset service provider] in Luxembourg, offers integrated digital asset financial products and services, including bank-grade digital asset custody and fiat rails, cash and options trading, crypto-currency backed fiat loans, innovative digital asset management products, asset tokenisation solutions and B2B banking for regulated financial institutions.

In January, Matthias Imbach and the fintech raised $90m in a Series B round led by Sun Hung Kai & Co. Limited, a Hong Kong-listed alternative investment financial services institution. It is supported by Canadian investment firm Meta Investments; blockchain, non-fungible token (NFT) and gaming specialists in the metaverse, including Animoca Brands and Wemade; founders of leading decentralised finance (DeFi) protocols and existing strategic investors, including SBI Holdings and Siam Commercial Bank's digital investment arm, SCB 10X.

The $90m brings its valuation to $800m, so not yet unicorn status, but it also allows to cope with the falling value of the products it trades.

$250m from the crypto to a BlackRock ETF

On Tuesday 1 November, it announced the launch of specialist NFT services for professional creators, the Web3 community and its banking clients. The services range from strategy definition for an artist who would like to issue one or more NFTs [tokens representing works of art and considered as such] to their exchange between artists and investors or even between investors, including in euros, dollars or Swiss francs, via a credit card or a crypto card without any additional fees (the gas fees of other platforms).

In early October, Sygnum Bank finalised a partnership with Maker, a decentralised provider of loans from digital assets. The Swiss bank will place $250m of collateral on behalf of Maker, which will then be diversified into traditional assets via a portfolio of iShares fixed income ETFs from BlackRock Switzerland. A second tranche of $250m is expected in a second phase.

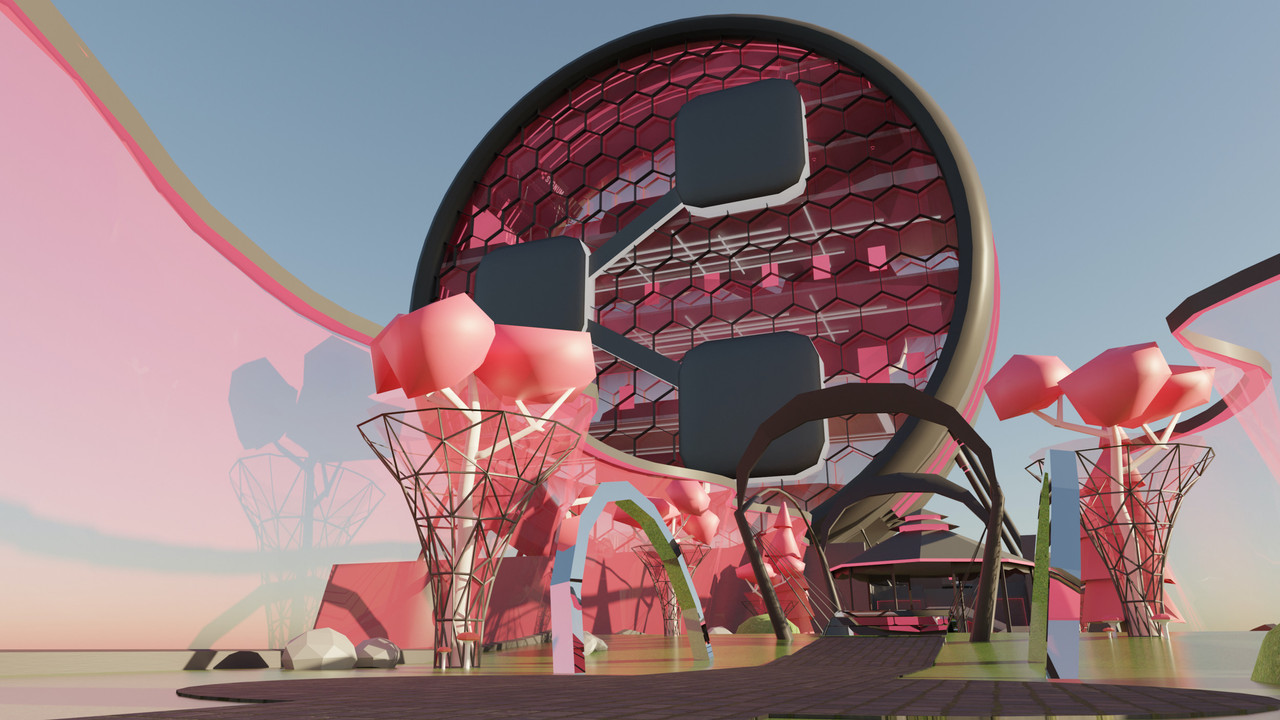

On 1 September, (in the virtual equivalent of New York’s Times Square in Decentraland). The hub includes a CryptoPunk receptionist, an interactive NFT gallery and an event space.

This story was first published in French on . It has been translated and edited for Delano.