Asia-Pacific is now the world’s biggest trading bloc. For investors seeking new growth drivers, Asia is a region with a lot of potential. “If you look at the Asian economy and its contribution to global growth over the past few years, you can see why investors are more and more interested in this continent,” says Julie Dickson, CFA, an investment director at Capital Group. Just over 30 years ago, Asia accounted for about 10% of the global economy; today it’s around 35%. It’s the fastest-growing region in the world.”

Over 16,000 listed companies

The market has really taken off in the space of just a few years, offering a wide variety of investment opportunities. In the 1980s, there were only a few hundred listed companies in Asia; now there are over 16,000. What they offer has also changed considerably. “Twenty years ago, many Asian companies were basically imitators of what was happening elsewhere, notably in technology and communications,” points out Dickson. “Now, they’re full-fledged innovators in a wide range of sectors: semiconductor manufacturing, the development of global digital platforms, the Internet of Things, biotech, and so on. This transformation points to high long-term growth potential for these companies.”

Not one but several flourishing markets

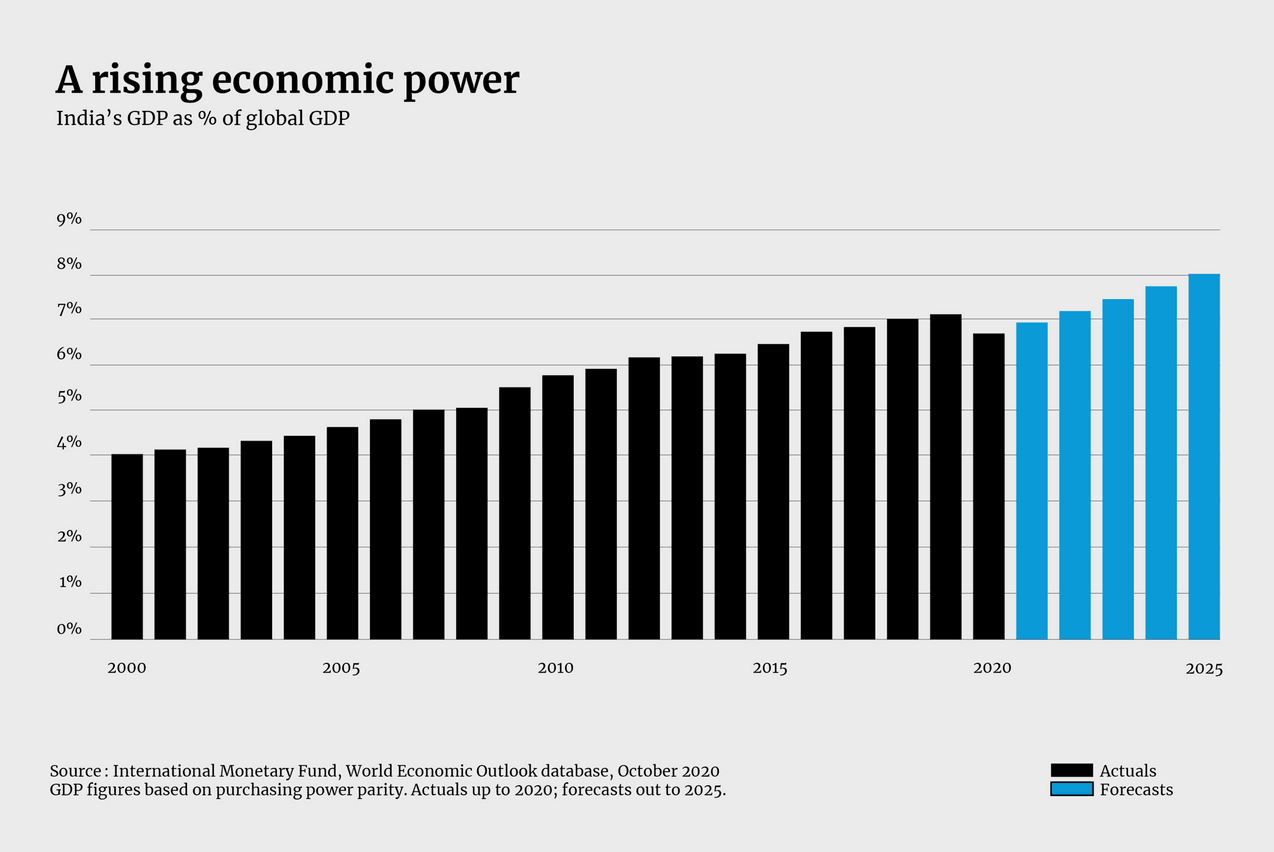

But investing in Asia from a long-term perspective requires a good understanding of this still very fragmented economic region so as to be able to spot the best investment opportunities. “China is obviously a key driver of Asia’s growth, but it’s not the only one. India is the next rising economic power. Other countries in the region also offer real potential. Asia is not one single market but a number of territories, each with its own economic dynamics. Between local firms addressing their domestic markets, local players with global potential and global players, the key is to succeed at spotting the top growth drivers,” says Dickson.

Maison Moderne

Spotting the best opportunities

To allow its clients to benefit from all the region had to offer, Capital Group moved into Asia very early, opening its very first Asian office in Hong Kong, China, 35 years ago. Since then, the global management company has continued to invest across the continent, including Southeast Asia and the Middle East. The group now has offices in Tokyo, Singapore, Mumbai, Shanghai and Beijing. “The real key for our teams – and for any investor – is to spot companies with the potential to generate steady, strong and lasting growth,” continues Dickson. You have to be able to assess as accurately as possible how much value a company can create and the risks that go with its growth, taking into account its market, evolving consumer expectations and regulations. Beyond that, you have to make sure your investments are diversified across the whole region, drawing on detailed analysis. All of this is key to any successful investment.”

To learn more about Capital Group’s areas of expertise, visit