What do you think about the latest developments in the oil sector?

DP: Western countries want energy that is both clean and affordable. Some sources, like onshore wind and solar, offer both. But in many other parts of the energy chain, cleaner energy costs more. And as costs escalate, so do the challenges, which creates tension for the global economy.

Oil companies are moving in this direction, to varying degrees. The European majors have solid plans to try and work with society to decarbonize, whereas the major US oil companies have been less proactive. BP, for example, is moving aggressively into renewables. Chevron and ExxonMobil, on the other hand, have been less willing to change.

Capital Group voted for activist shareholders to join the ExxonMobil board. What’s the message behind that?

DP: It’s about the transition to a business model emphasizing renewable energy sources, but it’s also about profitability. A company cannot have industry leadership and a sustainable bottom line if it does not have a long-term strategic plan for investment in lower-carbon energy.

A company cannot have industry leadership and a sustainable bottom line if it does not have a long-term strategic plan for investment in lower-carbon energy.

CB: I think the vote had to do with more than just climate change. Exxon’s financial performance has lagged in recent years, resulting in ballooning debt, credit downgrades and questions about its ability to maintain the dividend.

What impact does this have for legacy oil assets?

CB: For several years, we’ve seen demands placed on the oil majors to divest certain fossil fuel assets. The risk is that these non-renewable assets could move from publicly traded oil companies to less environmentally focused producers, with less intense scrutiny of emissions. While individual companies may make progress, the world’s balance of emissions wouldn’t change.

The reduced investment in the sector may lead to a decline in supply just as world demand is recovering. This may in turn lead to higher oil prices, in which case the big oil companies would face a dilemma: if oil prices remain high, will they still be prepared to sacrifice investment in that business to continue their shift into renewables?

Does the OPEC agreement to boost supply change industry dynamics?

DP: In May 2020, OPEC members agreed to reduce supply through the period of the COVID pandemic. As demand now returns to normal, they are bringing some of that supply back. But the steep price drop in 2020 led to lower global investment and supply. Now, as demand normalizes, OPEC’s spare capacity is likely to be lower than pre-COVID. So oil prices look set to remain high.

How should these companies be valued?

CB: The big question for oil companies is how to decarbonize in a way that’s profitable — and how quickly and to what extent. For companies committed to renewables, it’s hard to calculate the amount of investment required to divest from their legacy businesses. They’re valued based on their future cash flows and return on capital, so proving that low-carbon energy will pay off is key to making the switch.

For companies committed to renewables, it’s hard to calculate the amount of investment required to divest from their legacy businesses. They’re valued based on their future cash flows and return on capital, so proving that low-carbon energy will pay off is key to making the switch.

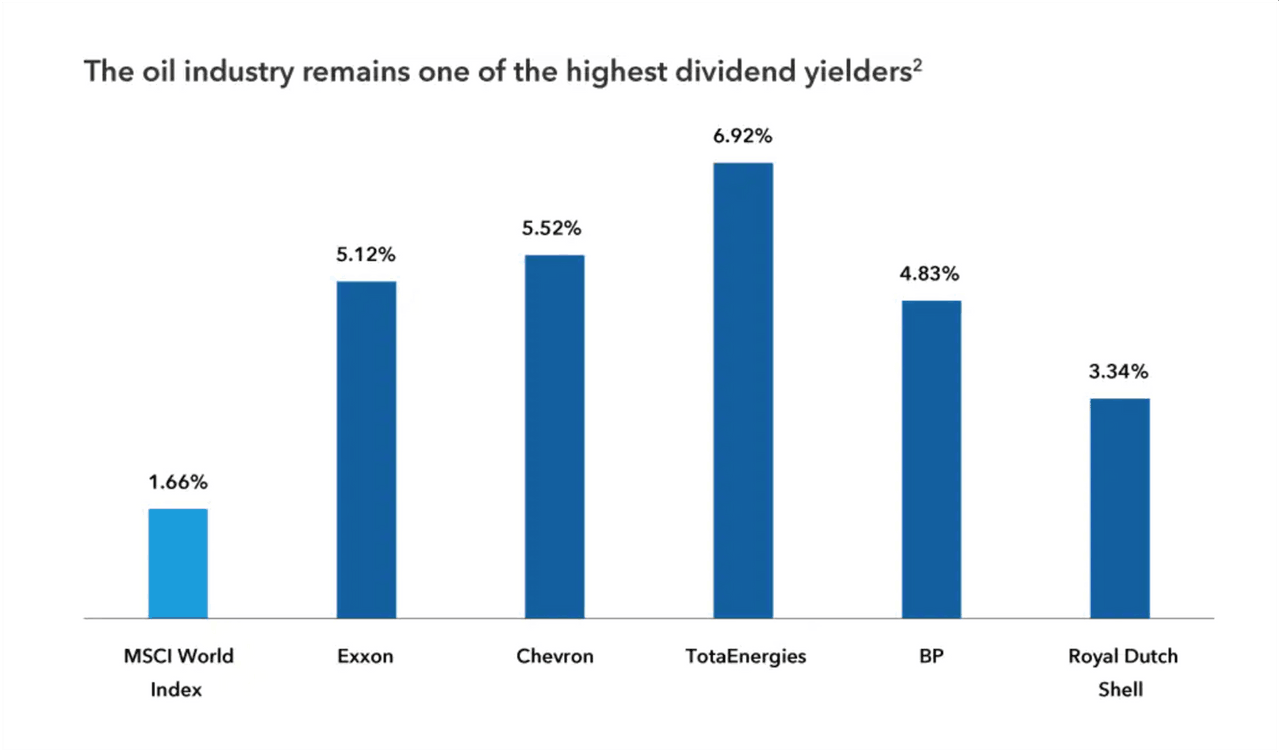

The oil industry remains one of the highest dividend yielders Capital Group

Interested in learning more? Further data and analysis by Darren Peers & Craig Beacock, equity investment analyst at Capital Group, is available

What do you see as potential outcomes over the next decade?

DP: The pace of our societal shift to a lower carbon footprint is still an open question, but I think that over the next several years demand for oil and gas will continue to grow, and then it may plateau before tapering off. Hydrocarbons are still the cheapest way to fuel societies and economic growth. An alternative would be to develop additional carbon-reducing technologies, to make existing technologies more affordable or to reach an agreement on putting a higher price on carbon.

More needs to be done to encourage this transition, including helping bring costs down and promoting a shift to alternative energies through carbon capture requirements or financial incentives. Oil companies potentially have several areas to pivot within alternative energy, such as hydrogen and biofuels. But while the value chain in renewables is similar to how the fossil fuel sector is structured, the assets are different in terms of the way they’re produced, transported and distributed to end-customers.

There needs to be massive investment in alternative energy sources if the world is going to reach a goal of net-zero carbon emissions by 2050.

Interested in finding out more?