“I think I was the only one during the election campaign to raise the issue of pensions at a roundtable. I even asked the question twice. And both times, the candidates’ answers were dissuasive.”

, president of the Luxembourg Employers’ Association (Union des entreprises luxembourgeoises, UEL), is a staunch advocate of in-depth reform to make pensions sustainable. “It’s a fundamental issue for the coming months,” he told the future CSV-DP coalition. Reckinger points out that, more than a year and a half ago, the government commissioned the Economic and Social Council (ESC) to look into the matter. “The ESC has worked on this, but unfortunately the unions are refusing to issue a joint opinion. This is irresponsible. The situation is serious: the coffers are emptying.”

This could be the government’s second major project, after tax reform.

As things stand, however, Luxembourg’s public pensions are in good shape. In 2020, the Organisation for Economic Co-operation and Development (OECD) compared the state of reserves, expressed as a percentage of gross domestic product (GDP). At 33.6%, Luxembourg is on a par with Sweden (31.8%), well ahead of France (6.7%) and Germany (1.2%). Hervé Boulhol, head of pensions at the OECD, sums up: “Luxembourg currently has sufficient reserves to deal with unforeseen events. But, of course, it is feared that the situation will deteriorate significantly as the population ages.”

Dwindling reserves

As of the end of 2022, pensions are in the black: cash benefits (€5.7bn) are amply covered by contributions from policyholders and employers (€4.4bn) and the state (€2.2bn), according to the latest report from the National Pension Insurance Administration (Caisse nationale d’assurance pensions, CNAP). The pure pay-as-you-go premium, which expresses the ratio between benefits and the contribution base, will reach 21.89% for the 2022 financial year, which is lower than the current contribution rate of 24%.

On the face of it, everything would be fine if reserves had not fallen by €2.6bn last year. When asked about this, CNAP chair Alain Reuter was reassuring: “This essentially concerns the reserve invested in the financial markets, which suffered from developments on these markets during 2022. The general pension insurance scheme has not had to dip into the compensation fund reserves to finance pensions in Luxembourg.”

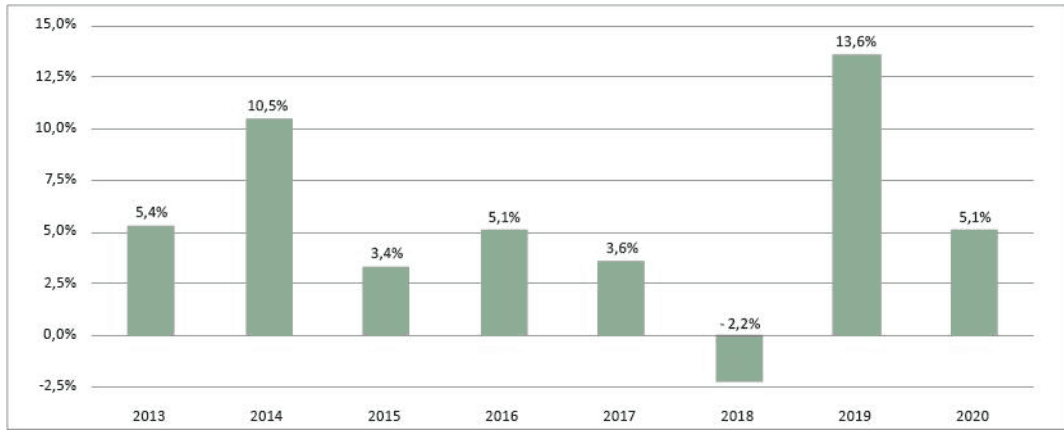

Return on the reserve fluctuates sharply

Much more than fluctuations in returns, it is the 2027 deadline that is worrying observers. In that year, the pure pay-as-you-go premium should exceed the overall contribution rate--this is the basic scenario used by the Inspectorate General of Social Security (IGSS) in its 2022 technical report on the general pension insurance scheme. Clearly, in all likelihood, the pension system will fall into deficit in the short term. “2027 is tomorrow,” worries Idea Foundation economist Jean-Baptiste Nivet.

Between 2013 and 2020, the return was negative only in 2018. It then rebounded in 2019. Source: IGSS/Technical assessment of the general pension insurance scheme 2022

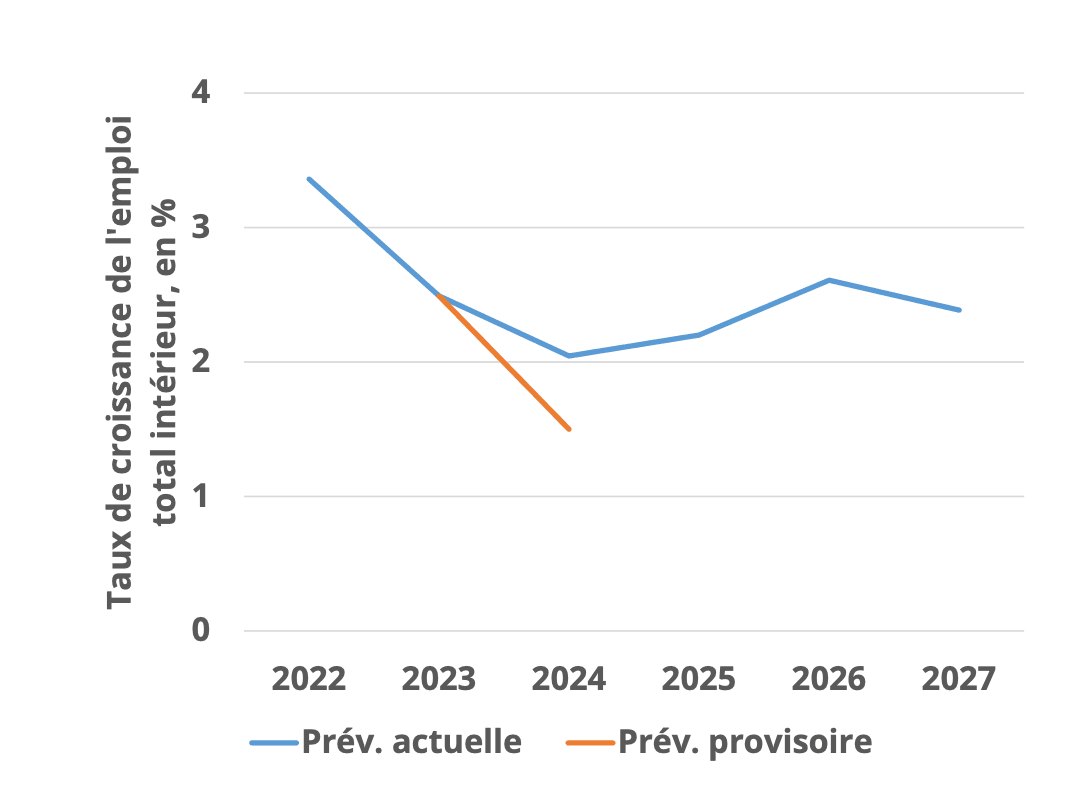

A key factor in the sustainability of the system is employment growth. The latest figures available are in line with the IGSS’s assumption of only 2% growth in the working population between 2020 and 2030. However, as Nivet points out, “these simulations show that the pension system is unsustainable in the short and medium term. What’s more, they do not take into account the slowdown in job creation to below the 2% mark,” as mentioned by the country’s statistics bureau Statec.

Employment slows

The fall in activity is having an impact on employment in Luxembourg. Source: Statec/Note to the trainer, 12.10.2023

To avoid plunging into the red in 2027, a reform will be necessary in 2025 or 2026, according to the economist: “This may be the government’s second major project, after tax reform.” The Idea Foundation proposes to reduce the proportional part of pensions while increasing the flat-rate part. As it stands, the Luxembourg pension system is neither sustainable nor fair, says Nivet: “The distribution of the wealth created in Luxembourg over recent decades has tilted in favour of pensioners to the detriment of working people.”

2027 is only the first unpleasant date. In the IGSS’s base scenario, the reserve is exhausted in 2047. In the long term, between now and 2070, pension expenditure is set to rise steadily in Luxembourg, from around 9.2% to 18% of GDP, says the European Commission in its latest report on ageing. Ageing is adding another pressure factor: Brussels is forecasting moderate growth in the working population. According to Eurostat projections, the resident population should rise from around 615,000 in 2019 to just over 785,000 in 2070.

Expectations on productivity

“The European Commission is assuming that Luxembourg will gradually lose its attractiveness and that the influx of foreign workers will slow down,” comments Nivet. “It’s hard to say whether this will prove true, but I have my doubts. The hypotheses that were circulating in Luxembourg in the 1980s, 1990s and 2000s have turned out to be far from reality. Similarly, major innovations could bring about providential leaps in productivity in the future.” Fortunately for our pensions, the worst is never certain.

This article was first published in French on . It has been translated and edited for Delano.