The end of a cycle ?

According to the Capital Group expert, who analyzed returns generated over the past decade, the “value vs. growth” model is harder to pin down and thus riskier to implement.

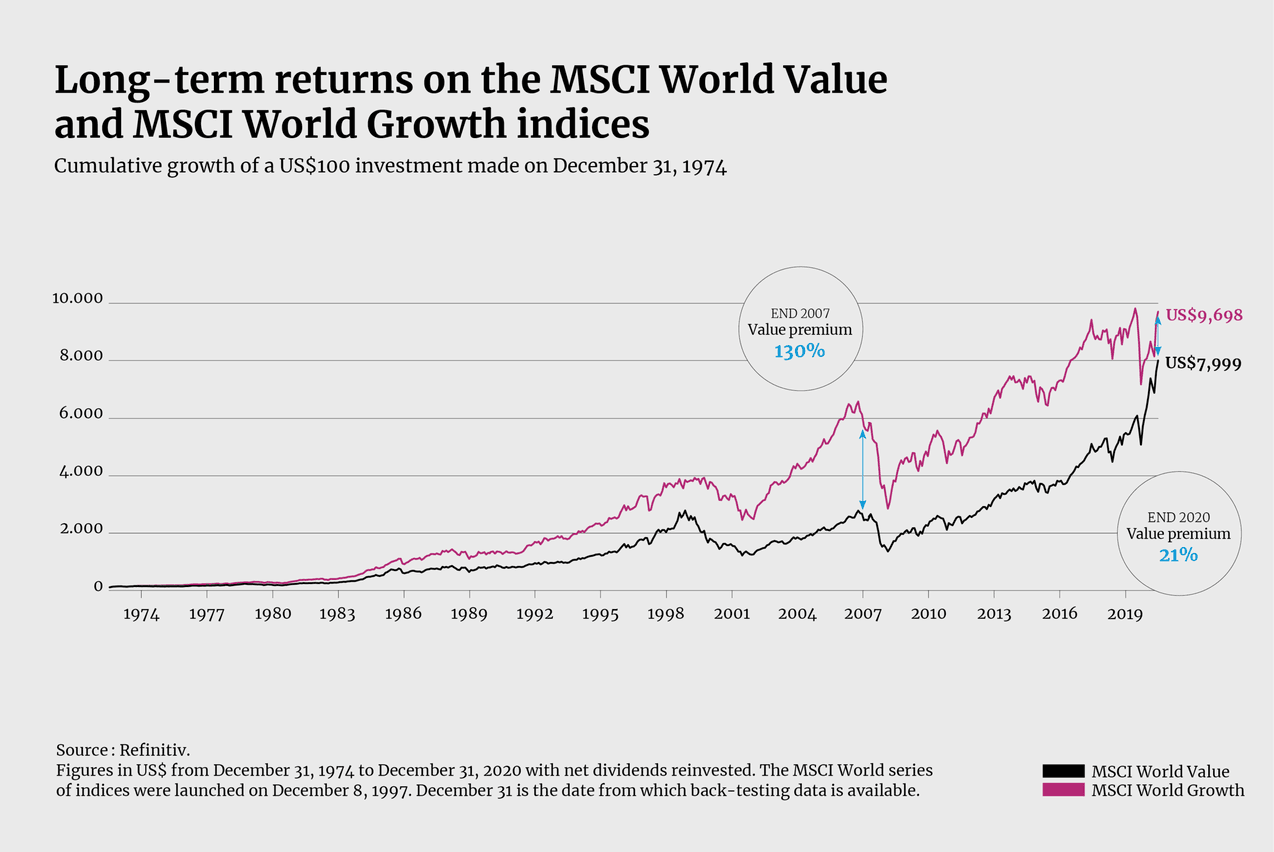

Long-term returns on the MSCI World Value and MSCI World Growth indices. Capital Group

Fundamental changes in the economy

She believes four major changes underlie the weak earnings growth associated with the use of traditional models. “Firstly, value-heavy industries like banking and energy have been in secular decline. These industries, which could previously always be relied on to generate solid returns despite periods of turbulence, now face unprecedented challenges,” explains Thakrar. “Secondly, digitization – which is driving the ‘fourth industrial revolution’ – has divided winners and losers.”

Thirdly, industry composition has narrowed, making it trickier to diversify portfolios, whichever style you prefer. And fourthly, with the rise of the knowledge economy, growth in intangible assets has made determining intrinsic value increasingly complex. “For investors committed to one of the two traditional styles, the challenge is that it’s getting harder for them to fundamentally understand the intrinsic value of a business, whatever the asset in question,” explains Thakrar.

Responding to new forces at play

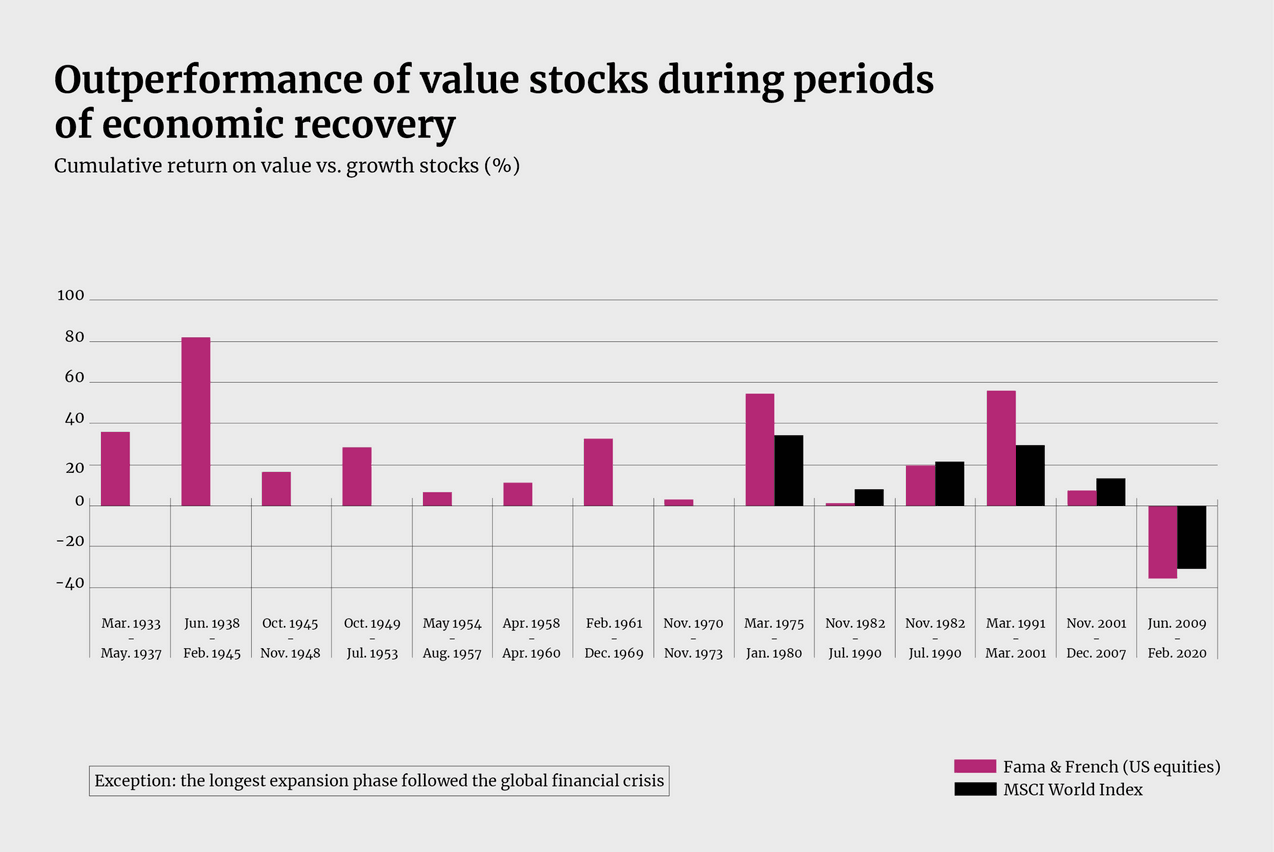

All of which raises the question of whether separating the two styles is as meaningful as it was in the past. Over the last century, value stocks have recovered strongly after periods of poor returns, but this new evidence questions whether we can always rely on the persistence of a new value resurgence or the ability to time rotations.

Outperformance of value stocks during periods of economic recovery Capital Group

“Instead, investors should look across the whole universe to select stocks that meet their capital appreciation and income objectives,” says Thakrar. “To do this, it’s more important than ever to turn to advisors and fund managers who can focus on fundamental valuation, accounting for new forces such as digitization, intangible assets and narrowing industry composition.”

To learn more about Capital Group’s areas of expertise, visit