Luxembourg : a great place for investing

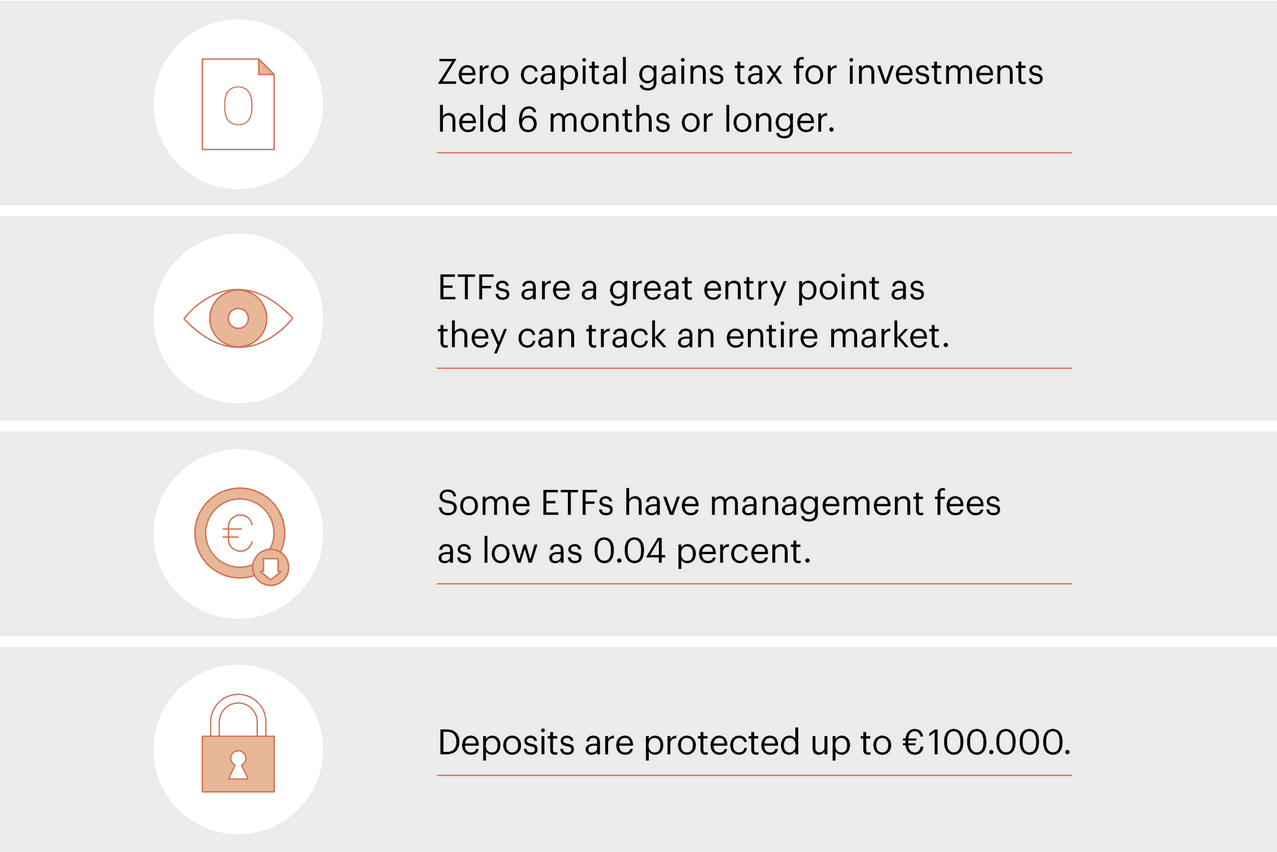

Residents of the Grand Duchy enjoy advantages that investors in other countries may not have. Notably, if you hold an investment for six months or longer, you do not have to pay capital gains tax on it, and this includes cryptocurrencies. Also, in Luxembourg, there is no financial transaction tax on buying and selling stocks and shares on an exchange. Another great advantage is that Luxembourg is deemed very safe for investors and offers substantial protections.

Fix your goals

No matter if you are investing a thousand or a million euros, you need to determine your investment goals. These might be planning for retirement, having money for a down payment on property, or wishing to fund your children’s university education. Weigh this against the lifestyle you want to enjoy, what you need in expendable assets, and it will become easier to work out the degree of risk you need to take to meet those goals. Then, set up a time horizon for your investing, the longer the better.

People need to have the discipline to just continually invest and not get scared by short-term volatility.

Consider starting with ETFs

An easy way to start investing is with a basket of exchange-traded funds (ETFs), which are very liquid and transparent instruments and can track a whole market. This grants you diversification and exposure to a stock market index such as the S&P 500 or the Euro Stoxx 50, or to bonds, precious metals and other asset classes. Investing in an ETF also means you do not have to pinpoint and choose particular stocks. Still, many investors do go on to invest in individual stocks, and more speculative instruments, once they gain knowledge and experience.

Choose an investment provider that does not eat into your performance

It is difficult to time the market, but one variable you can control is how much you pay for your investments. It is important to choose a provider such as Swissquote which offers low commissions on trades. This means that even as your portfolio grows and you do well, you still enjoy a low overall cost of having the account. Some banks in Luxembourg still charge an annual custody fee, which eats into your investment returns over the long term. You should also select an investment product that is as low-cost as possible. Some ETFs have management fees as low as 0.04 percent, whereas traditional investment funds offered by large retail banks often charge more than 1 percent annually, which can really eat into your investment returns.

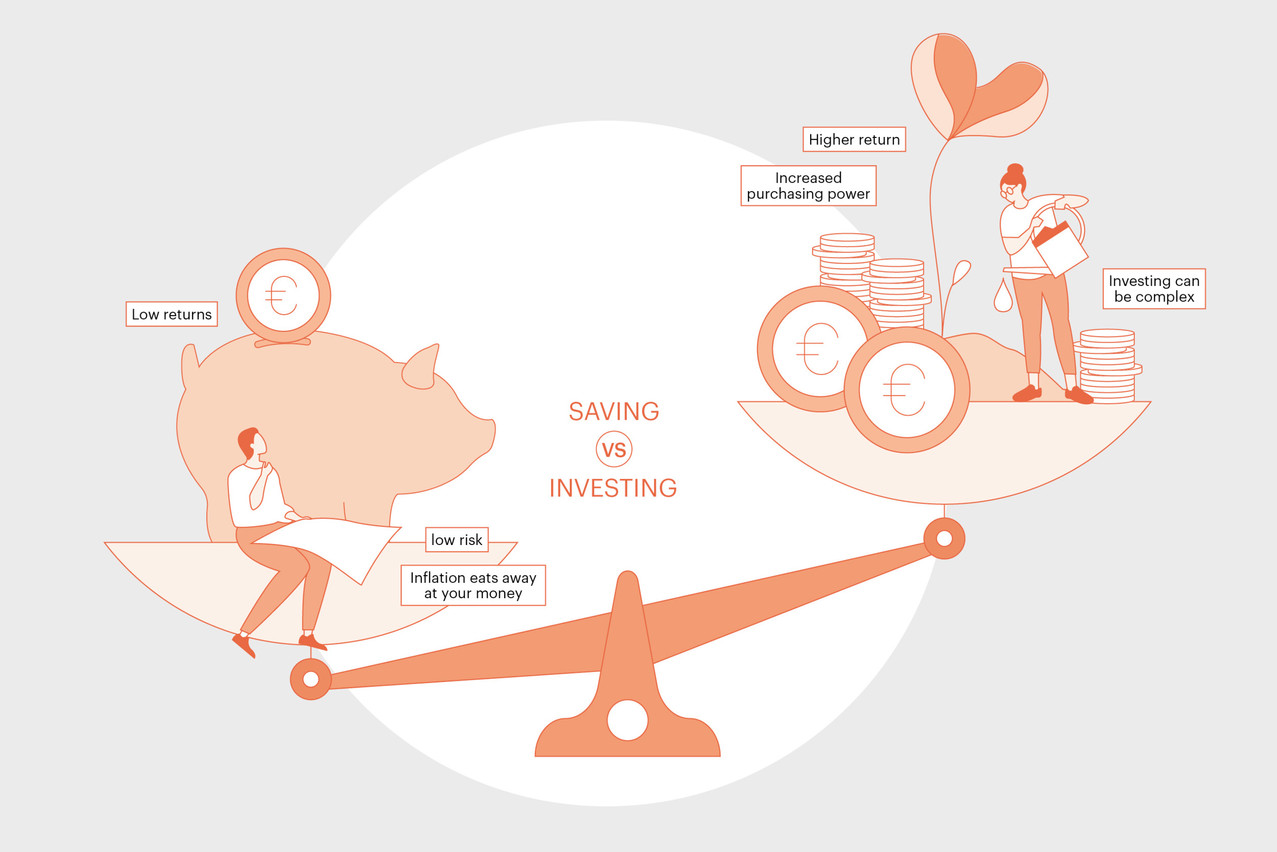

Inflation is really eating away at anything you can put in a savings account, even if you find a half-decent positive return.

Control your emotions and think long-term

The other thing beginner investors should try to control is their emotions during times of market volatility, and consider markets in the long term. What was interesting during the Covid market correction in 2020 was that retail investors were buying the correction, which was in contrast to their behaviour after the credit crises market crash in the 2000’s. Time is the investor’s best friend, and it allows you to see out the dips in the market. Looking at the early days of the pandemic in 2020, there was a 30 percent market correction. Six months later, the pandemic was still here, but the markets had recovered that 30 percent. Markets go down as well as up, and history tells us that over time, there is never really a wrong moment to start investing. Various studies show that stocks, over the long term, will perform better than most other investments.

Facts : Investing in Luxembourg

Investing in Luxembourg. Maison Moderne

To learn more about investing, go to