The current environment

The attractiveness of the bond market has been revived over the last two years, due to the sharp rise in interest rates. Some investors are attracted by the total return offered by bonds and therefore pay less attention to valuations. The yield on a corporate bond is made up of the risk-free rate plus a premium to compensate for the counterparty risk (credit risk). This risk premium is historically low (if we omit the periods when central banks flooded the market with liquidity) and is explained by expectations of a soft landing for the economy. Although the likelihood of this scenario is relatively high, given the sharp fall in inflation in recent months and the potential for monetary policy easing, current valuations do not seem to incorporate scenarios of a sharper slowdown.

Passive versus active management

Against a backdrop of attractive interest rates, ‘Buy & Hold’ management is competing with more active management, which was crucial when yields were mainly in negative territory. Buy & Hold is essentially based on yield at the time of portfolio construction. This type of management is ideal for the most defensive clients, whose main objective is to maximise visibility of returns over a defined period.

Active management, on the other hand, continually adjusts its positioning in order to increase return expectations or reduce volatility by seizing market opportunities. On the other hand, this slightly reduces the visibility of future returns. Even in a context of high interest rates, active management remains highly relevant and can improve the risk/return profile compared with more passive/traditional management.

The most active bond management is flexible and involves making many absolute and relative choices. For example, an active manager has to decide on sensitivity to changes in interest rates and risk premiums, on the asset sub-classes making up the portfolio and on the choice of all the instruments available on the bond market.

This third aspect--namely, the choice of instrument--is examined in greater depth later in this article.

Dispersion and choice of instrument

Depending on market conditions, it may be appropriate to have a greater or lesser proportion of direct lines, investment funds and/or ETFs (exchange-traded funds). Often criticised, the choice to have a higher proportion of funds/ETFs in a bond portfolio can be seen as an active management choice.

At first glance, direct lines appear to be the preferred choice for investors, but in reality, in certain market configurations, it is preferable to limit idiosyncratic issuer risk by increasing diversification. To define this choice, it is interesting to study the dispersion of returns within each bond sub-asset class. Indeed, when we study the level of risk premiums, it is common to look at changes in average bond premiums. By averaging these premiums, we remove the dispersion information.

To analyse the current level of dispersion in the credit market, we have chosen to focus on investment grade bonds denominated in euros. The factors chosen to explain the dispersion of risk premiums are: the difference in rating between bonds (mainly reflecting the quality of balance sheets), the sector of the bond issuer and, finally, the dispersion induced by the positioning of the bond on the yield curve. These three factors are not exhaustive and therefore do not explain all the dispersion, but they provide a good basis for this analysis. Other factors such as the size of the bond issue (liquidity), the issuer’s country of risk and the size of the issuer are also sources of dispersion.

It is important to note that the sum of these dispersions is not equal to the total dispersion; for example, the dispersion due to positioning on the curve incorporates that due to rating differences. This is because bonds with long maturities are generally of very high credit quality, so there is an overlap between the analysis factors. We assume that each analysis factor is not significantly biased by the others, thanks to the broad diversification of the universe studied.

The change in dispersion visible in Figure 1 (calculated using Bloomberg indices) shows that the current dispersion for the three factors is at historically low levels, below their historical average. As rating dispersion is the most significant of the three factors studied, choosing a bond with an improving rating will be an important driver of performance.

Counter-intuitively, curve dispersion fell in March 2020, while the dispersion of the other two factors rose significantly. This is because in periods of extreme risk aversion, the risk premium curve tends to flatten. Short-term bonds become riskier due to immediate economic uncertainty. At the same time, long-term bonds, which are generally of better credit quality, are less affected and thus contribute to the flattening of the curve.

All other things being equal, greater dispersion means more opportunities on specific rating bands, sectors, curve points or issuers. In this case, direct lines are the best instrument for taking advantage of these opportunities and increasing yield expectations. On the other hand, low dispersion reduces the importance of choosing a specific bond relative to other management decisions, and the use of diversified instruments is recommended.

Evolution of dispersion. Source: Bloomberg

It is also interesting to analyse the correlation between the sum of the dispersions of the three factors and changes in the average risk premium of an investment grade bond index (Bloomberg Euro-Aggregate Corporates Index). Unsurprisingly, this correlation is very strong: the average 6-month correlation over the last 10 years is around 0.82. In other words, the higher the risk premiums, the greater the dispersion. This is a good time to take advantage with a large proportion of direct lines in the portfolio. However, the opposite is often observed: when economic conditions are favourable (low dispersion), investors tend to select direct lines because of their increased confidence; they generally favour more diversified instruments during periods of risk aversion.

The choice of instrument also depends on the weight of the sub-asset class in the portfolio and its nature. The lower the weight, the easier it will be to find a few attractive direct bonds to fill this pocket. Very specific sub-asset classes, known as niches, can also be delegated to specialists.

It is also possible to study the evolution of the contribution of each component of a factor to dispersion. It is theoretically possible to have low risk premiums and low dispersion, but for this to be mainly explained by a rating band, a specific sector or a curve point. The contribution to dispersion of ratings and positions on the curve is relatively stable over time; however, at sector level, Figure 2 shows strong variations between sectors.

For example, in 2015, the materials sector accounted for 46% of sector dispersion due to the slowdown in Chinese growth and the sharp fall in commodity prices. More recently, the financial bonds sector (including property companies) has been impacted by the rise in interest rates and then by the default of several banks in 2023. Relative opportunities remain in this sector due to the level of contribution to dispersion observed, but the return to the historical average seems well advanced.

Contribution to sector dispersion. Source: Bloomberg

Impact on portfolio construction

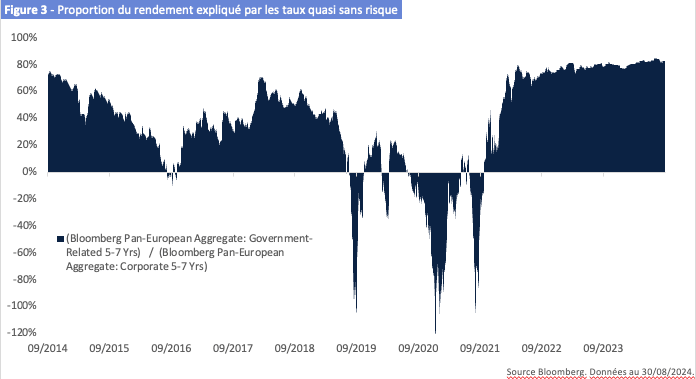

In an environment characterised by low dispersion and low risk premiums, it seems appropriate to increase portfolio diversification and average credit quality. The proportion of investment grade corporate bond returns explained by near-risk-free rates is now around 83% (compared with 43% over the past 10 years - Figure 3). Government or quasi-government bonds now represent a valid alternative to investment-grade corporate bonds, which has not been the case for a long time. These bonds should therefore regain their place in bond portfolios. Within the portfolio's riskier bond pocket, the heterogeneity of the bond market makes it possible to diversify risks, particularly those associated with the more fragile balance sheets of high-yield bonds in an economic slowdown. This can be achieved, for example, by positioning on subordination risks through financial subordinated bonds or hybrid corporate bonds.

Proportion of return explained by near-risk-free rates. Source: Bloomberg

Although there is no single factor that will drive up risk premiums and dispersion in the short term, we believe that the bond credit market is not immune to volatility, and that preparing for it will give us greater flexibility and enable us to seize future opportunities.

Optimal management of bond portfolios requires an understanding of market dynamics and economic fundamentals, as well as proven expertise. Continuous adaptation to market conditions is essential to maximise returns and minimise risk. This underlines the need for specialist knowhow to adjust effectively and seize opportunities, whether with direct lines or diversified instruments.

*Patrick Lambert is CFA, senior fixed income portfolio manager at Edmond de Rothschild (Europe).

This article was originally published in .