The question is simple, the answer seems complicated. In what kind of investments have the millions of euros from the state and its investment bank, SNCI, been dedicated to as part of the new space sector announced by Etienne Schneider's in January 2020, where he extolled the appeal of serious investment structuring.

Three years after the resale for the symbolic sum of €1 of the shares of the American company Planetary Resources, acquired for €25 million, comes the subject of state investment in new space taboo. When contacted, the Ministry of the Economy replies that it has nothing to do with the strategies of private players and that one should contact the Société nationale de crédit et d'investissement to get an idea of the tickets put into this booming sector, whether by the SNCI, the Luxembourg Future Fund or the Digital Tech Fund.

Except that as the SNCI annual report states, the public bank invested alongside the Ministry of the Economy in the Orbital Ventures fund, created in Luxembourg by the American company Promus Ventures. The investment funds rushed to the call for public offering, says a good connoisseur of the issue. And the American fund that won the bid owes it to its experienced duo, Mike Collett and Gareth Keane.

The EIF, the largest contributor ahead of Luxembourg

Recently, Orbital Ventures publicly announced in the United States that it had closed the fund at €118.2 million--the €70 million that was originally discussed plus the amount that the European Investment Fund added. Contacted at ICT Spring, which opened this Tuesday at the new Conference Centre, the fund's manager, Pierre Festal, said he could not give details of the list of investors who participated in its creation. "The biggest investor is the EIF (European Investment Fund)," he admitted, "and the non-Luxembourg investors have less than 10%.” The rest comes from Luxembourg, he confirms, the SNCI and a series of private companies "invited" to take part. That is, BCEE, BGL BNP Paribas, BIL, OHB, Post Luxembourg and SES, according to Etienne Schneider's three weeks before his departure at the beginning of 2020 when he was already accompanied by Franz Fayot (LSAP). In Cannes, at the premises of Thales Alenia Space, where a delegation from SES came to see its SES17 satellite, the head of communications confirmed on Monday that the company had participated, as a way of giving back to the country what the latter had given it, without specifying the amount.

A few weeks after this first announcement, at the beginning of February, and after months of waiting and preparation, the former minister announced that he had asked the SNCI to put an additional €10m into another fund, New Space Capital, so that the country could play all the necessary investment cards--that is, all the development phases of start-ups and other SMEs. The sum could reach €18m if opportunities arise.

The SNCI, slots in its usual role as investor, the Luxembourg Future Fund, the Digital Tech Fund--managed by Expon Capital--, Orbital Ventures take on seed investments and New Space Capital--investments in companies in their growth phase. While in each of these cases the objective is obviously not to lose public money, and if possible to gain some--Schneider said that he hoped for a capitalisation of €500m from New Space Capital in the medium term--the idea was also to bring business to Luxembourg.

20 more new space companies in Luxembourg

Although the Minister for the Economy and its departments did not want to communicate the amount of public money invested, Franz Fayot indicated at the opening of the Space Forum on Tuesday that the Luxembourg ecosystem had grown from 50 to 70 space and new space companies based in Luxembourg. This is not necessarily related, but it is worth looking at.

In 18 months, all these financing structures have taken stakes in about ten companies that had to be sought out one by one when their fundraising is not covered by the finalisation of contracts. This is the case of the latest American geospatial nugget, found by Orbital Ventures. "A small ticket," explains Mr Festal.

So far, Orbital Ventures has invested in Isotropic Systems (UK)--in which SES also has a stake--Ellipsis Drive (NL), Akasha Imaging (USA) and Fernride (GER), in "rounds of between €2m and €3m on average", admits the manager of the Promus Ventures sister fund in all transparency.

In February, round of funding led by Luxembourg-based SES, for which it is a strategic investment for its supersatellite infrastructure in two orbits.

, and led by 10X Capital, "Orbital Ventures was the second largest investor," says Festal. The release seems to indicate that US Promus Ventures is the first alongside BlaBlaCar CTO Olivier Bonnet.

Two other investments have not really been announced but will be over the next two to three weeks. Yet the €5m invested in are already listed as an off-balance sheet event in Orbital Ventures' annual report. The Paris-based start-up wants to revolutionise logistics by enabling itself, through data and algorithms, to move from a reactive to a predictive mode. It is easy to understand the interest in using data from space to improve logistics.

The other investment will be the UK's , a proper caricature of the "garage start-up" that specialises in waste management and which has the largest database of images of products to be recycled in the world. It is not yet known how much the deal will cost, but it has a special feature. The Luxembourg fund is to invest two-thirds of the money it was lent in European companies and the remaining one-third in the rest of the world, mainly in the US, where much of the new space development is taking place. Since Brexit, investments in UK companies are counted in this part of the package.

The Iceye deal

On the New Space Capital side, only one investment is mentioned: €18m in the Finnish company Iceye, as part of the €66m ($87m) batch of financing in September 2020, in which the Luxembourg Future Fund, the SNCI (via the Dutch OTB Fund Coöperatief) and Promus Ventures (the parent company of Orbital Ventures, therefore not with Luxembourg capital) also participated. This radar imaging specialist has launched its own constellation.

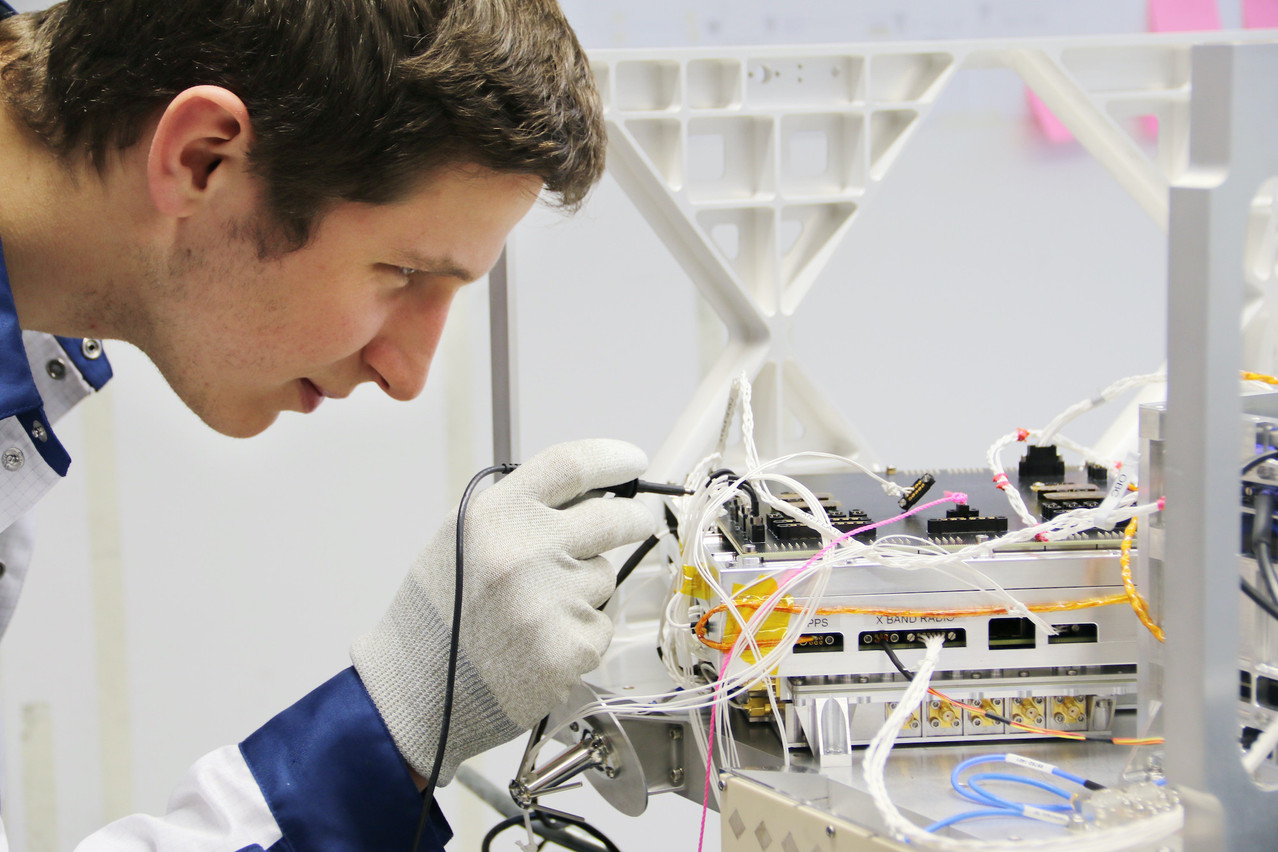

Testing microgravity in an object the size of a wallet, an idea born in 2014 at NASA and on which Yuri Gravity is working. The German start-up set up its research centre in Luxembourg last year. (Photo: Yuri Gravity)

A good investment for Luxembourg. Especially since the start-up created a research centre in Luxembourg in June 2020. In his short speech, the minister mentioned two other arrivals, which were not, in principle, financed by the public purse: the German company , which specialises in the democratisation of microgravity and has won a number of notable prizes, such as that of the European Space Agency in 2020, has registered a subsidiary, Yuri Lux, in Belval in July 2020; and the American company Flawless Photonics, which wants to take advantage of its arrival in Luxembourg, in April 2020, to launch a fab lab to improve its new-generation optical fibre.

One last company, Hydrosat, has been registered in Luxembourg since 2018, but had not given any sign of life there until the publication of its annual report, on 27 October 2020, for its first year and a half of operation. In June, the US start-up raised $5m, a total of $10m since its inception, with Expon Capital and the Digital Tech Fund providing part of the funding. The company specialises in water issues using its multi-spectral and thermal infrared technology, which will be launched with Loft Orbital on SpaceX Falcon 9 in 2022. The company plans to launch an additional constellation of 16 satellites with the ability to scan the entire globe daily, generating a scientific grade infrared and a land surface temperature product ready for analysis.

"Everyone knows that the Luxembourg state is very strongly involved in the development of new space," affirmed almost all the speakers at the ICT Spring Space Forum on Tuesday. Others will find fault with the €30m to €40m already invested. How to find the right balance? An eternal question for those in charge. Eternal, because it was already asked in these terms 35 years ago, when the government forced the creation of SES with large-scale guarantees that could have ruined the country but ended up providing it with its greatest industrial success.

This story was first published in French on . It has been translated and edited for Delano.