This main inflation relief for households can amount to up to €84 per month depending on salary. Here we have compiled the questions you might have about its application.

Will I be entitled to the tax credit?

There is no difference between cross-border commuters and residents: anyone earning less than €100,000 gross per year in Luxembourg is entitled to the CIE. Pensioners, recipients of Social Inclusion Income (Revis) and Income for the Severely Handicapped (RPGH) benefits will also be entitled to it.

How much will I get?

If you earn less than €3,667 gross per month, you will benefit from €84 net per month.

If you earn between €3,667 and €5,667, the calculation is as follows 84 - (gross monthly income - 3,667)*(8/2,000) If you earn between EUR 5,667 and EUR 8,334 per month, the calculation is as follows 76 - (gross monthly income - 5,667)*(76/2,667)

How will I receive my CIE?

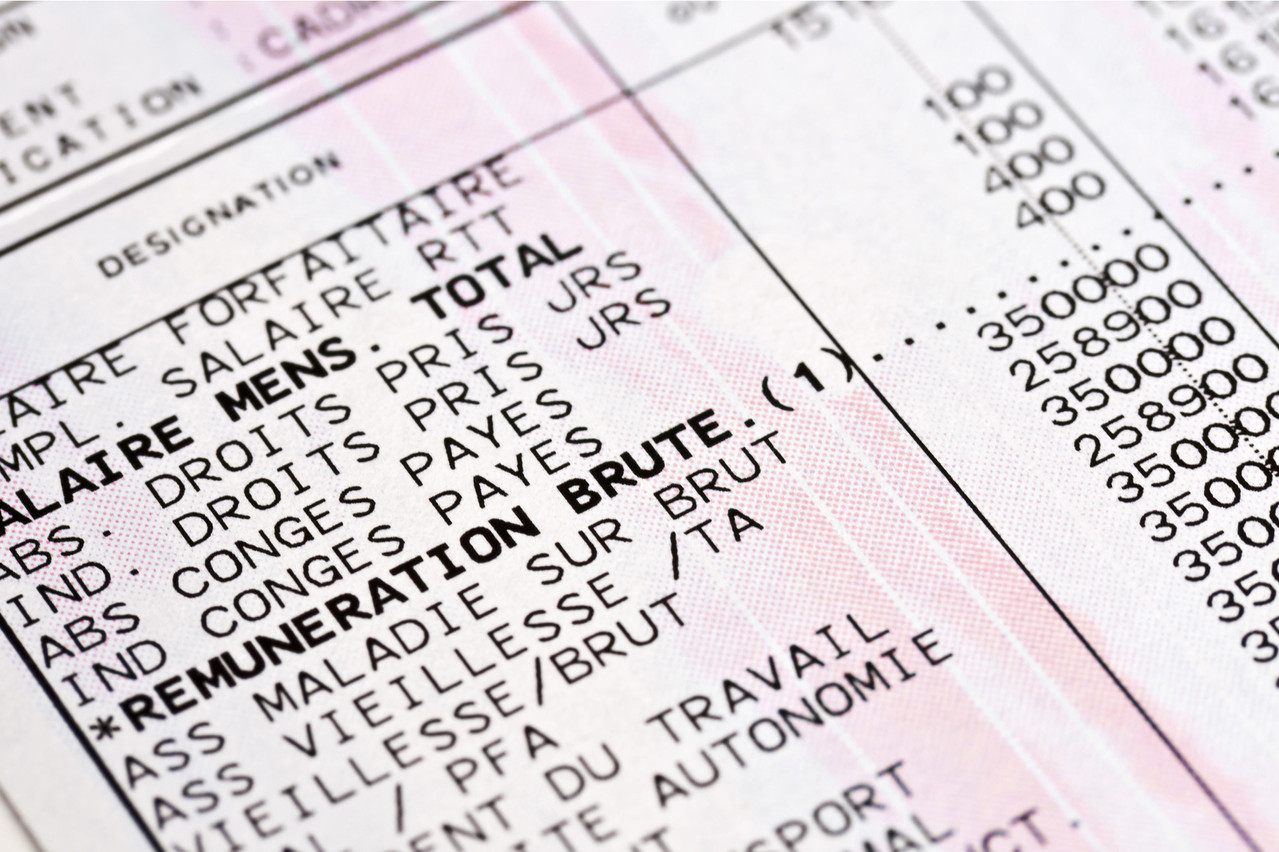

Employees will find their benefits noted on their payslip, in the same way as with " explains Marco Philippy, head of the Withholding Tax Division at the Direct Tax Administration (ACD). Contributions and taxes will be deducted as well. There will be a line included for adding the tax credit followed by the net salary that the employee will receive, including the tax credit. “The employee does not have to do anything. It is his employer who pays him” before being reimbursed by the government. The employee will therefore only have one monthly payment into their account.

Is 13th month salary included?

“For the moment, the texts are still being drafted,” says Philippy. But “in principle, it is planned to ignore the 13th month or other bonuses” regardless of their amount.

Can you refuse your CIE?

There is also the qestuons of whether a cross-border commuter who is taxed in their country of residence (because they have other income in that country, for example) can refuse the CIE, if the amount puts them in a higher tax bracket and they loses out. ”Generally no, it is an obligation for the employer to pay it,” says Philippy. He points out that the income indicated on the tax return is, in any case, gross in Luxembourg, so the CIE has no impact. This applies in France as well since the introduction of the new tax calculation method.

What happens if the index does not get triggered in August?

The CIE is intended to compensate for the postponement of the second index scheduled by national statistics bureau Statec for August 2022 to March 2023. But if the index were to be triggered as early as June, would the CIE be applied earlier? Conversely, if it was triggered in November, would the deferral and therefore the CIE go until April 2023, or would it be shifted by eight months to July 2023? "You have to ask the finance ministry” is the answer, as it is they who are preparing the legislation. Delano's sister publication reached out to the ministry which was unable to provide an answer.

Does the CIE really compensate for the deferral of the index?

It depends on the salary. Indexation would have meant a 2.5% increase in gross salary, whereas the CIE is a net amount. For example, someone earning the minimum social wage of €2,313.37 per month, or €1,960.36 net (according to Calculatrice.lu) would have seen their salary rise to €2,359.6 gross, or €1,994.02 net with a second index. This is an increase of €33.66, while with the tax credit is a contribution of €84 more net each month. Similarly, someone earning €5,000 gross per month would have earned €62 net with indexation, compared to €78 with the CIE. On the other hand, someone earning €7,000 gross per month misses out, as they go from €88 net with indexation to €38.1 with the CIE.

This story was first published in French on . It has been translated and edited for Delano.