On all tax returns that were completed in 2021 on taxx.lu, the leading online tax return service in Luxembourg, users benefit, on average, from a tax refund of €855. If only those who received a refund are considered, the average refund is even €2.352.

Is it mandatory to file a tax return in Luxembourg ?

There are different criteria that make the tax return mandatory. For example, if your household has an annual taxable income exceeding €100.000 or if you receive several incomes in the same household, such as two different salaries. The same applies, of course, to households that have received income that was not taxed at source: if you rent an apartment to a third party, for example, and you have received rent, then this income has not been taxed. You must therefore declare this income on your tax return.

Why file a tax return, even if it is not mandatory?

The Luxembourg system allows you to deduct some expenses on your tax return, which allows you to reduce your tax burden and benefit from a tax refund!

Examples of such expenses are the following:

Interests and insurance

Interests on personal loans, credit cards or credit overdrafts, liability insurance, life insurance, health insurance, ...

Limit of €672 per person in the household

Interests on the real estate loan

Limit per person, depending on the year of moving in:

2016 à 2021 : €2.000

2011 à 2015 : €1.500

Before 2011: €1.000

Private pension plan

Limit of €3.200 per person in the household (excluding children)

Home Savings Plan

Limit per person, depending on age :

From 18 to 40 years old: € 1.344

Over 40 years old: €672

Domestic expenses

Creèche fees, Maison Relaix, housekeeping expenses, ...

Flat fee of €5.400 per household

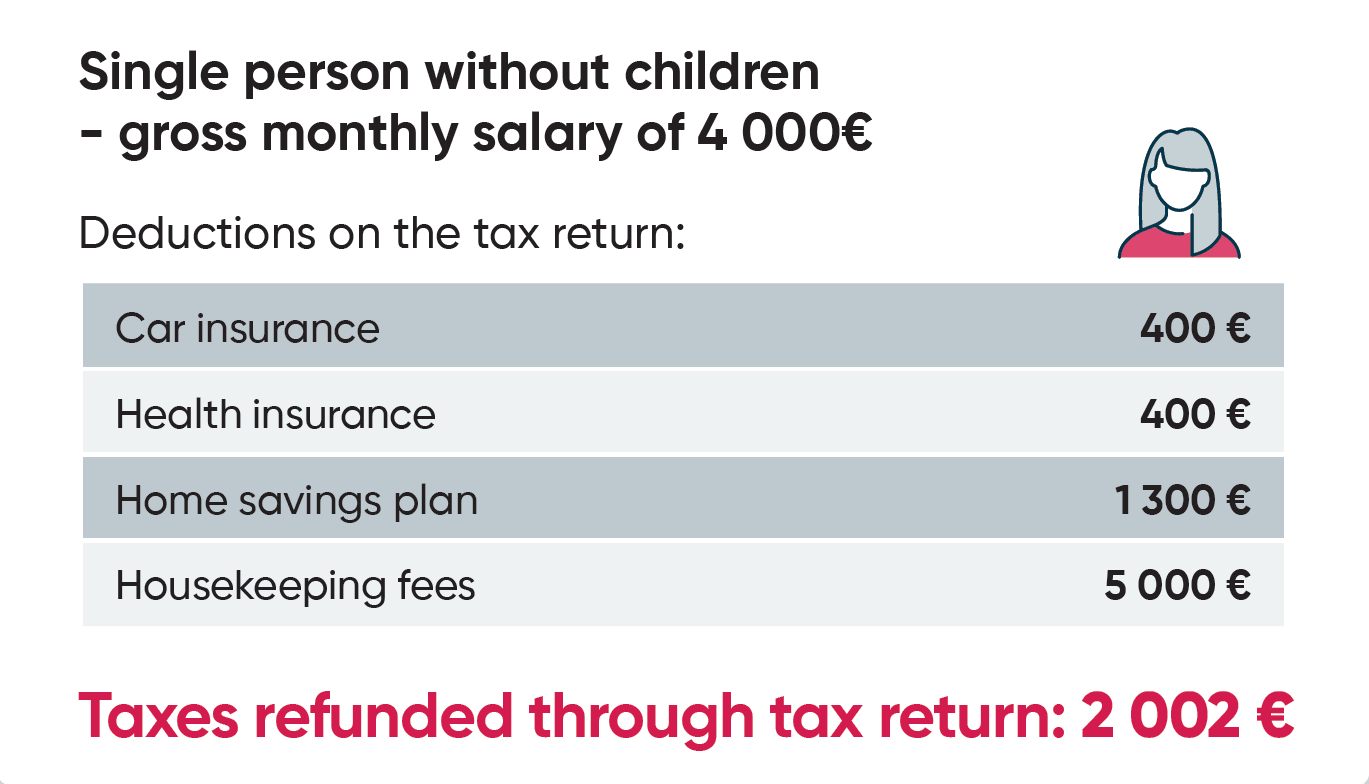

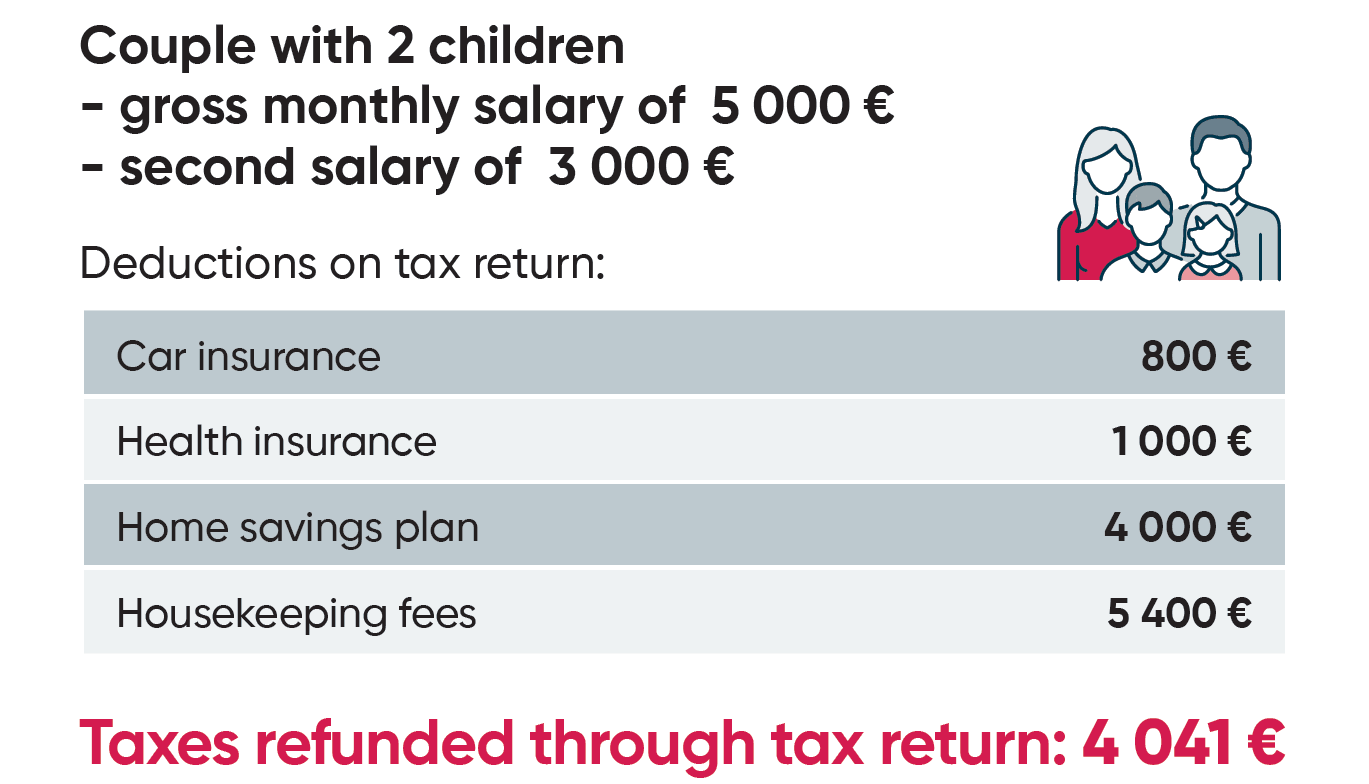

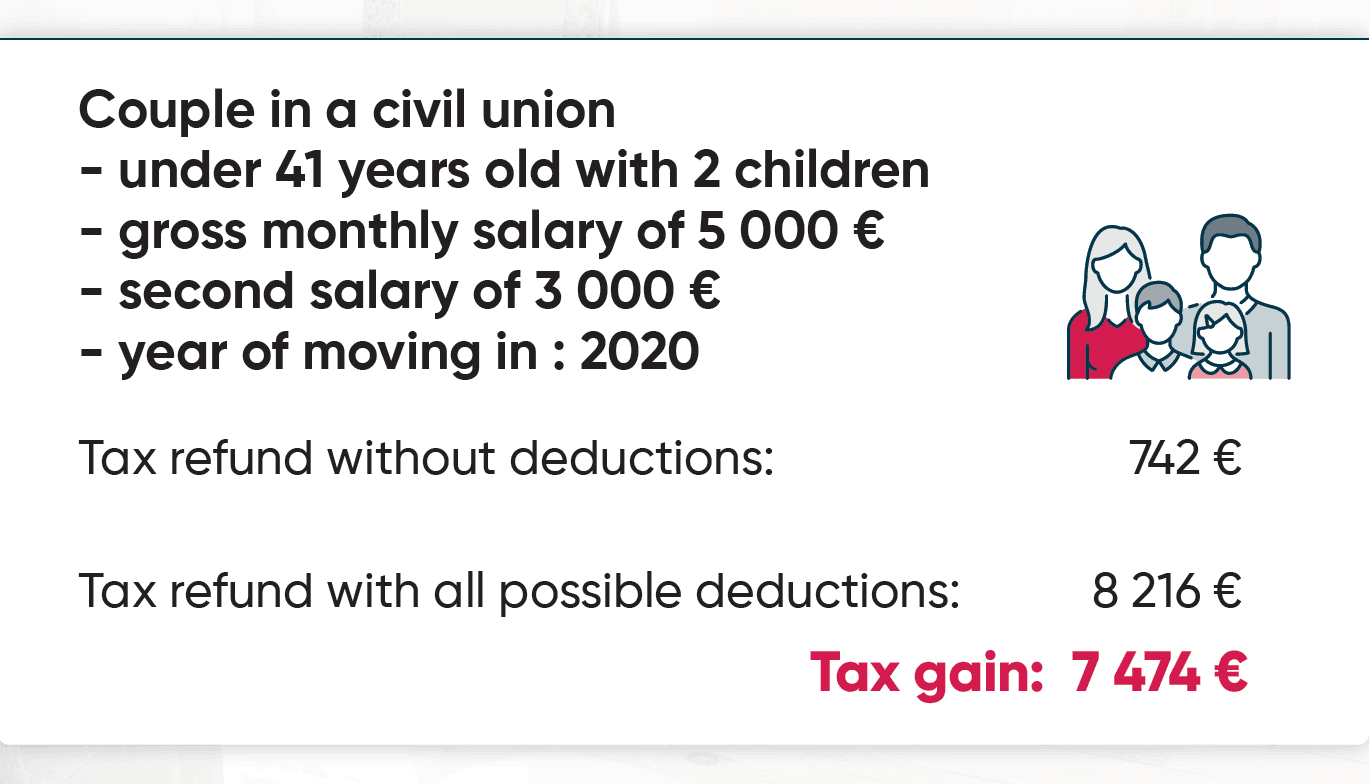

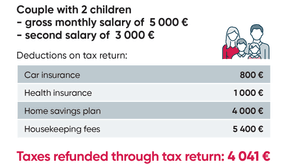

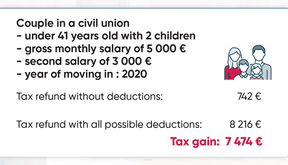

Examples of refunds

How do you know if you can get a tax refund?

On taxx.lu you can simulate a tax return and find out for free how much tax can be refunded to you.

Whether you are a resident or a cross-border commuter, taxx.lu allows everyone to file their tax return online to save time, money and stress! Import your previous year's tax return, scan your tax certificates with their "taxx.lu Scanner" application and your return is automatically filled out! The system determines the amount of taxes that will be refunded to you and advises you how to reduce your taxes in the future. And the best: taxx.lu is available in English!

For the price of €50, it's done! You can download your completed tax return and submit it to Myguichet.lu or send it directly to your tax office.