I hope you are all enjoying springtime in Europe. I have a and the rest of the year. While , (most) people did their homework and adapted to the new environment. Also at the early stage, I see great entrepreneurs being . Long-term value creation is back on the menu. If I combine this with all the tech innovations going on, one can only be optimistic.

If this market taught us anything, it is that the quality of investors matters...

One of the key topics that came up over the last weeks in my discussions with founders and investors was reserves and follow-on funding. today, not only for startups but also investors. The good thing is that this is nothing new. Markets are cyclical. Over the last twenty years, we have seen our fair share of ups and downs.

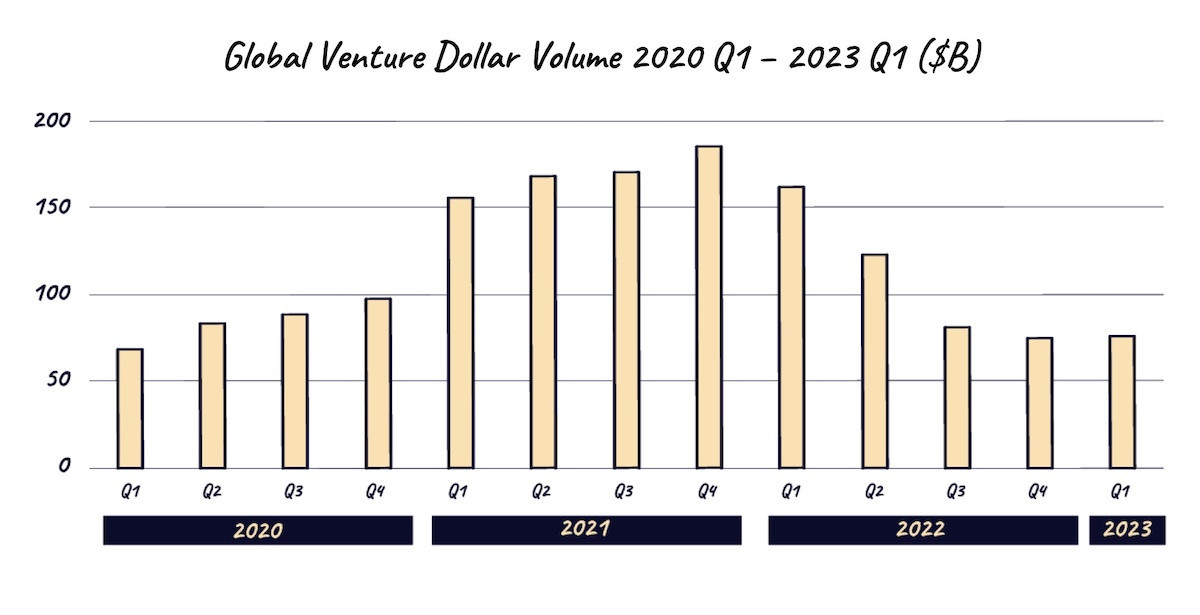

Global VC volumes have slowed in recent quarters. Image: Yannick Oswald

So, here is the thing with VCs today: If they have deployed their funds too quickly and are left with no reserves, they are ‘toast’, especially in challenging late-stage rounds. from the face of this earth. Every day that goes by, the opportunities get better for them. So why rush? This chart says it all:

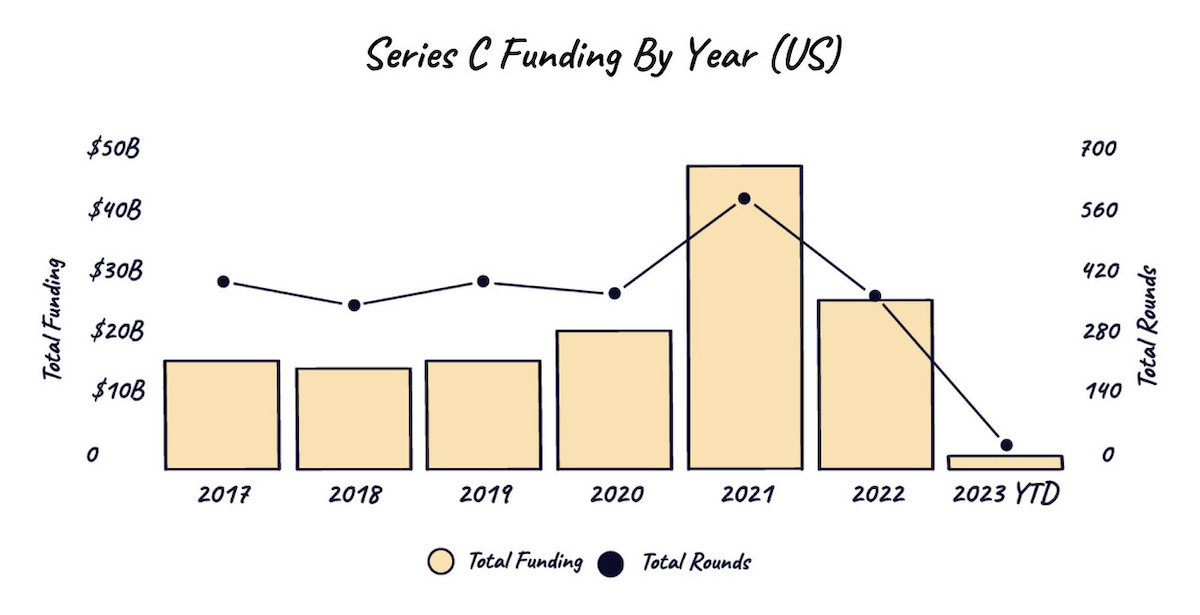

Series C funding rounds typically go to successful and growing startups. Image: Yannick Oswald

This is exactly the time when great VC firms not only step up to support their companies but also help them to funnel through. . Let’s have a look at what this means.

1. Funneling through. The support of a cheerleader.

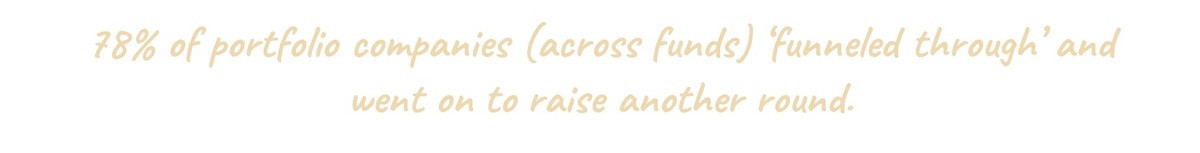

I recently crunched some portfolio data, and I updated this critical data point:

Three-quarters of VC-backed startups receive some sort of continued support from their VC firm. Image: Yannick Oswald

And >60% of those follow-on investors are other blue-chip venture firms. And these percentages will increase with the maturing of more recent investments. This is an important metric for us. For context, we are up against:

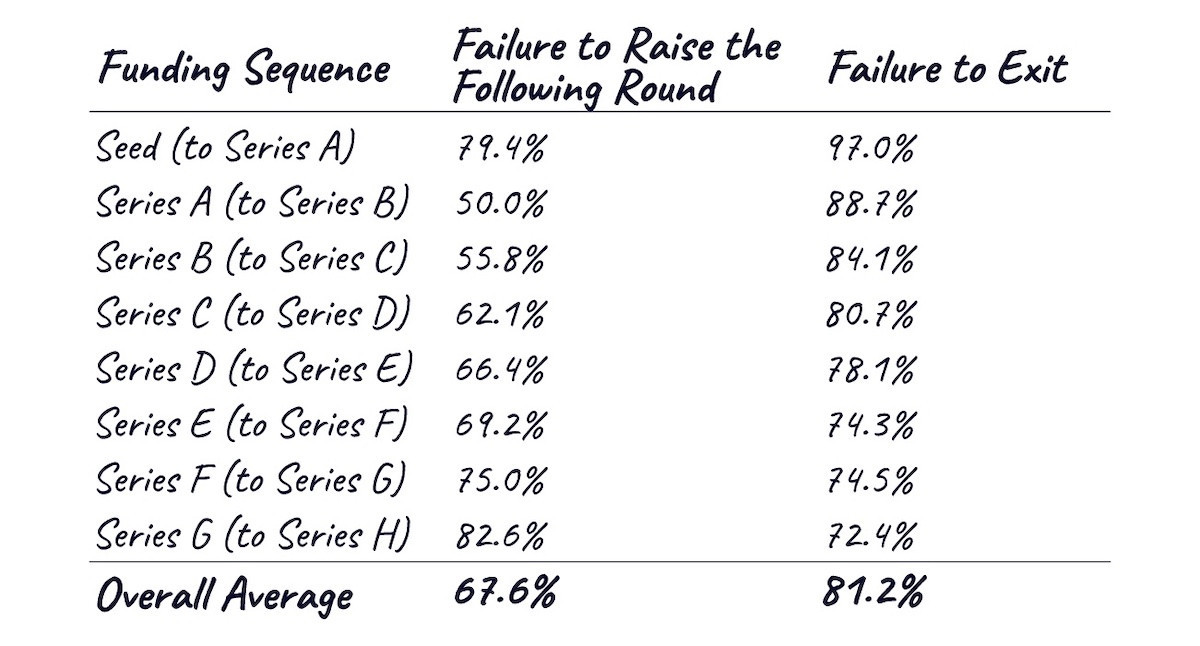

Difficulty in follow-on fundraising and exiting. Image: Yannick Oswald

Fundraising and network are the to founders. Raising capital from a great firm obviously sends a strong signal to the market and gives you a head start. But, fundraising is never an easy feat, and . For those who know me, I often say: ‘I love fundraising.’ I find the dynamics of these processes just fascinating. And it always is a challenge, no matter how great the outcome. I have gone through quite some processes by now. Each one is unique. I work tirelessly with my founders to get to that next stage. You can count on that:

The fundraising rollercoaster. Image: Yannick Oswald

Because we are facing a rash tightening not only of late-stage financing but also now. And this pullback from investors has created new dynamics around reserves... This brings me to my second argument on why you should raise from a great investor as early as possible.

2. Keeping reserves matters. The rise of seasoned venture firms.

Here is another key metric for us. This one is so crucial when it comes to strong founder support but also fund management:

Mangrove Capital Partners’ approach. Image: Yannick Oswald

What are reserves? Venture firms typically reserve a certain amount of their funds’ capital to support portfolio companies throughout their lifecycle. These reserves are essential to provide additional funding when necessary, meaning participating in follow-on investment rounds (usually required by future investors, see pro rata section below), to re-invest in companies that are doing great, but also to help companies weather unexpected challenges or market fluctuations as we face them today.

Most people think that VC is all about the initial portfolio construction, selecting the companies to invest in. But the truth is that is only half or less of it. Venture investing follows a power law. Reserves allow both, to , and to capture significant upside if things go right while remaining disciplined.

This is one of the unique things about early-stage venture investing. Most other asset classes, such as late-stage, public market, private equity, real estate and other popular classes typically involve a single or a time-limited series of investments.

2.1. Weathering the storm. The availability of reserves.

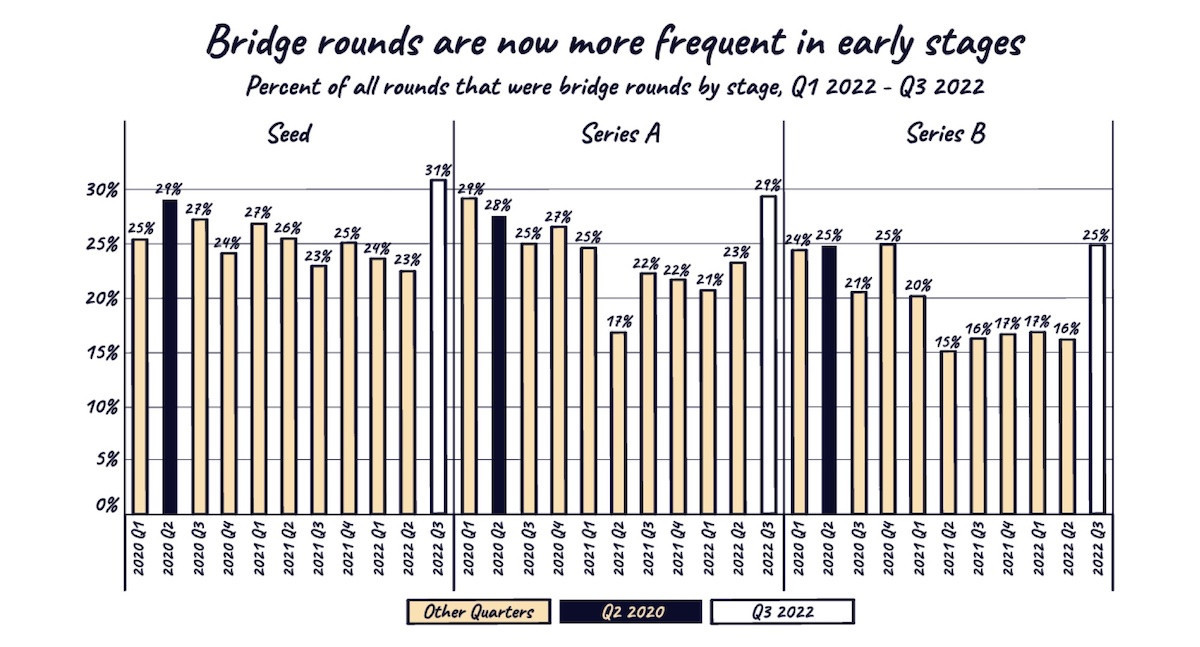

VCs are increasingly using bridge rounds () to keep their portfolio companies afloat. phases as well:

Bridge rounds are increasingly common. Image: Yannick Oswald

One crucial thing that separates a strong VC firm from all other sources of capital is that the best VC firms reserve significant capital for follow-on financings of their portfolio companies. They participate in subsequent financing rounds and do everything they can to attract other follow-on investors. The former differs from angel investors, small seed funds, growth funds, CVCs, or other strategic investors. I definitely don’t mean to play down these other capital sources. They all are critical at various stages but have a different modus operandi. .

So, ask new investors how they are thinking about reserves in the DD process. Here are some examples I’ve come across recently. 2021 was the year of fast, large follow-ons. Many companies raised those follow-on rounds very quickly. Some firms were so optimistic that they did their ‘pro rata’ in several quick rounds. The flip side is that they depleted their reserves more rapidly, leaving smaller reserves to protect their stakes today. On top, as the tide goes out, more companies than usual request inside now financing. With this double whammy on reserve management, firms have to focus their limited reserves even more. 2021 also saw a record of new funds. Many of those needed to make lots of new investments to show they are ‘in the market’. Reserves weren’t a focus. So, again, get a great VC firm onboard as soon as possible to avoid some of those challenges.

2.2. The right to re-invest. Pro rata rights.

When the early-stage folks make an equity investment, they typically negotiate for something called a pro rata right. This gives them the right to maintain their ownership in the company by investing in future rounds on the same terms as new investors. This does not mean that you can’t raise your next round from just insiders (your current investors), but, as the term suggests, the goal is to get new investors on board.

To be able to exercise this right, reserves are critical. Obviously, ownership at this first investment is the most important thing. Still, the ability to maintain it by making additional investments comes close second and can be the source of portfolio outperformance.

We value this right and exercise it very frequently. We often make 2-4 investments in a company, including our initial investment. We have seen these rocketships grow in the past. As the first institutional investor, we know the teams well, and want to get as much as possible of those assets over time.

Founders and future investors welcome the participation of earlier backers, and often require it even. It is a strong sign of confidence, especially if this earlier investor is a great venture firm... Also, if a business is doing really well, I tell founders that we are ready to take up (but don’t have to) more of a round than our pro rata, especially if it helps to close the round in a difficult market like today. This is an ‘excellent to have’ for founders...

So, , that would be a VC firm, particularly a top-tier VC firm. I am impressed and relieved by how many founders launching new ventures today get this. This is one of the reasons I am feeling great about the coming months... Onwards!

Yannick Oswald is a partner at the leading European venture capital firm Mangrove Capital Partners, most known for investing in companies such as Wix, Skype, Walkme, and K Health. Oswald backs early-stage tech companies across Europe and sits on the board of some of Europe’s leading tech startups, such as Flo Health, Sifflet and Red Points. In 2020, he started his blog , with the slogan “opportunities everywhere”, which grew into Europe’s most-read VC blog and a key resource for tech entrepreneurs on the continent. He publishes one post per month, usually on a topic related to venture capital and tech entrepreneurship. Oswald grew up in Luxembourg City, worked in several European countries and the US, and got his business engineering degree in Belgium and Argentina. This has been republished with permission.