Gen Z is aware that its wardrobe is polluting the planet, leading many to change their attitudes towards buying clothes. A study by GlobalData and second-hand specialist thredUP concluded earlier this year that the secondhand market would double to $350bn by 2027.

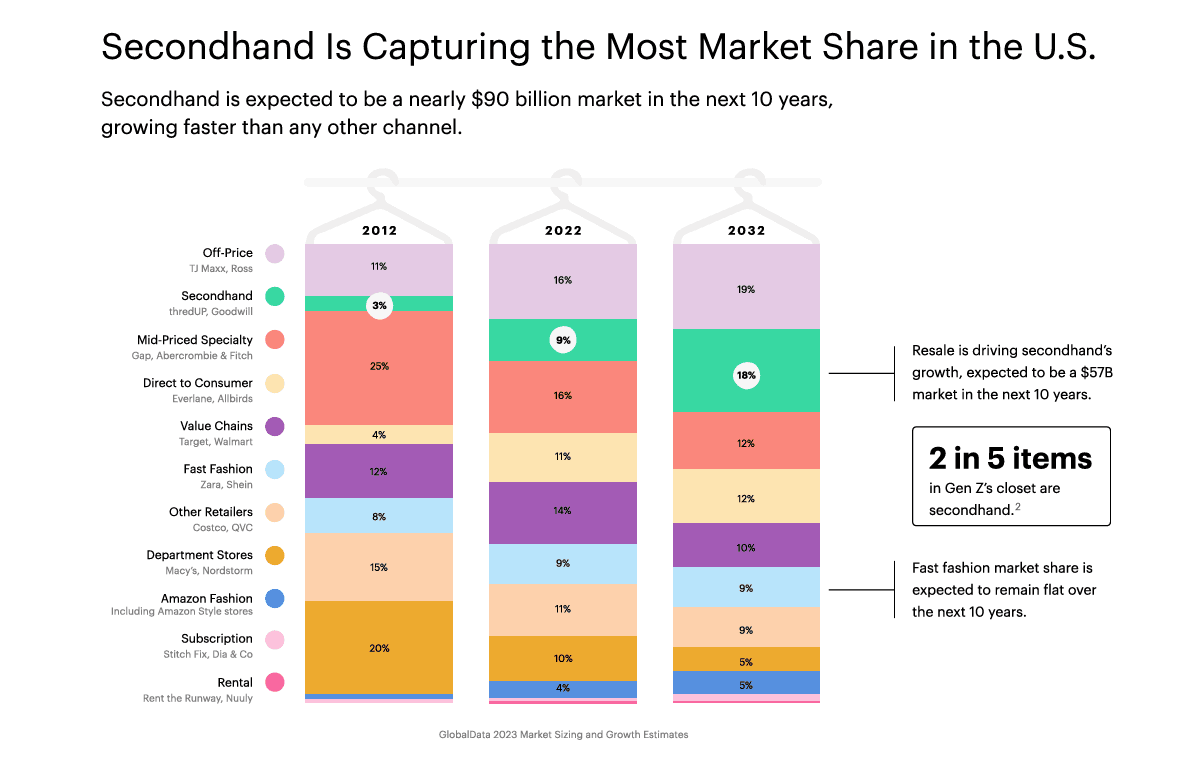

Focusing on the United States, the report shows that secondhand clothing will be the second-largest business in 2032, with 18% of the market share, behind off-price--which consists of selling below market prices, like TJ Maxx or Ross. There’s worse news for fast fashion brands like Zara: its market share will be limited to a maximum of 9%.

From 2032 onwards, the secondhand sector will be close on the heels of the off-price sector, while fast-fashion leaders such as Zara and Shein will level off. Source: GlobalData/ThredUP report

It’s hardly surprising that Zara, an integral part of the Inditex group, is trying to take (back) a share of this juicy business in the making. And not just any part: its secondhand brand, Zara Pre-Owned, only offers clothes that have been sourced locally. Three months after its launch, it will be available from Monday 11 December in Luxembourg and 13 other countries (Spain, Germany, Austria, Belgium, Croatia, Slovakia, Slovenia, Finland, Greece, Ireland, Italy, the Netherlands and Portugal).

It’s up to the customer to suggest an item, with the size and model, a photo and a short description. Zara’s moderators check that the advert is accurate and, once a new buyer has come forward, the seller has six days to dispatch the parcel. All this for a delivery charge and, of course, a commission for Zara.

A triple positive impact for brands

When the launch of this service was announced in France and the UK, the solidarity movement Emmaus raised a number of objections:

“Yes, buying secondhand reduces the environmental impact of fashion. But it is much less so when secondhand products are offered alongside advertisements for new collections. If we really want to take action, we need to consume less and better! But Zara doesn’t seem to have any intention of marketing better quality products that are designed to last.”

“And what about the social impact of all this? Encouraging private individuals to sell their clothes in good condition threatens the act of donating to charities and deprives them of an income that enables them to fund their solidarity initiatives. We are also still waiting for Inditex to ensure that Zara clothes are no longer produced by Uyghur populations.”

The American study shows that the brands hope to gain threefold from these strategies: to increase their own sustainability criteria by 9%, their customers by 9% and, above all, their customers’ loyalty by 28%. Loyalty in a clothing world that is becoming increasingly fragmented as a result of the creation of internet players specialising in niches that are little or poorly catered to by the major players.

This article was first published in French on . It has been translated and edited for Delano.