Proposed by workshop participants and communicated by corporate responsibility network IMS Luxembourg, the analysis tool would help companies better detect when staff and customers are at risk of falling into serious debt.

This would help those actors to provide budgetary support with various partners to prevent the worse from happening, IMS Luxembourg said on 19 November.

“Better over-indebtedness prevention would enable companies to reduce the costs linked with the processing of unpaid invoices and to put in place a committed policy for the well-being of their staff,” the outfit writes.

The project emerged out of a series of workshop organised by IMS Luxembourg along with the employment ministry, social and solidarity ministry, Uless and 6zero1, and involving actors in the public and private sector to help find solutions.

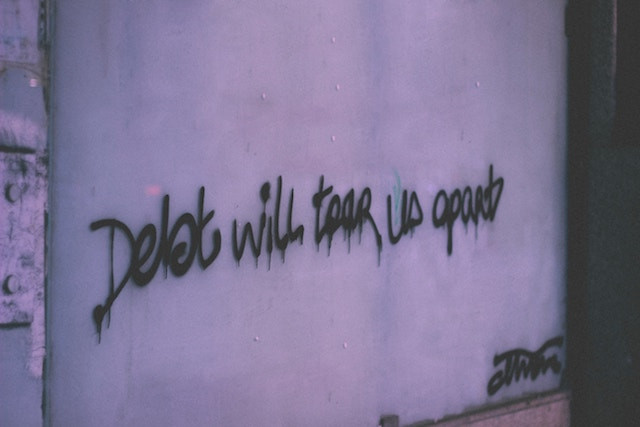

Other proposed measures include a financial education application for 12 to 25-year-olds, and a nationwide awareness-raising campaign to help break the stigma surrounding over-indebtedness.

“There has never been more over indebted people on the European continent than in 2018,” IMS Luxembourg writes, adding that while Luxembourg is among the richest, it “is not left unscathed; despite high salaries, the living cost and especially the real estate prices are particularly high. Although the vast majority of over indebtedness people are disadvantaged members of society, it also affects employees and senior executives.”

In 2017, La Ligue Médico-Sociale and Inter-Actions received 550 requests for help from over-indebted people.