A carbon tax is a price governments put on carbon dioxide that is created in the production and distribution of a good or service.

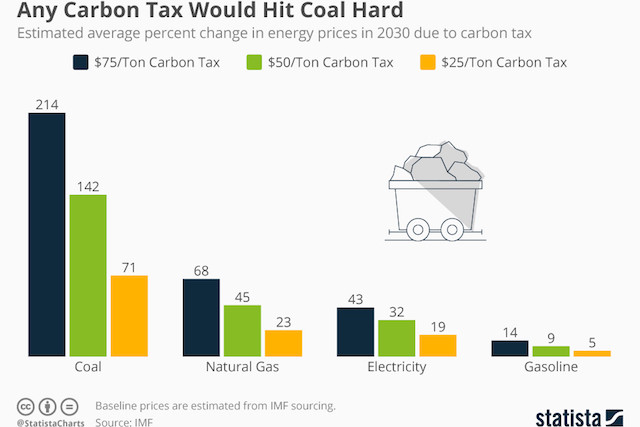

The report found that to meet the current goal of limiting average warming to 2 degrees Celsius or less, a carbon tax of $75 per ton of carbon produced would have to be instituted around the world and, particularly, in countries that are major emitters.

Under that scheme countries and businesses relying on high carbon energy sources, like coal, would see the biggest increase in their energy bills. On average global energy prices from coal would increase by 214 percent.

Since other types of energy, like natural gas, electricity, and gasoline, emit less CO2, the carbon tax would cause less movement in energy prices, even under a high tax scenario.

On average, global energy prices for natural gas would increase by 69 percent, while electricity and gasoline prices would shoot up by 43 and 14 percent respectively.