These include the reopening of restaurants and other shops that can implement health restrictions, as well as further flexibility on salaries and employer contributions, and the creation of an economic stabilisation fund.

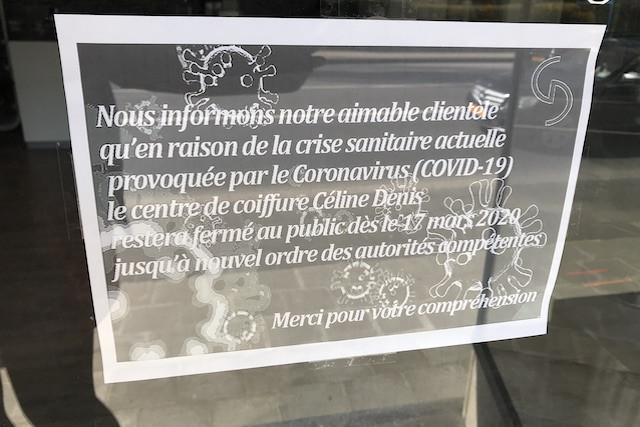

While some economic activity resumed on 20 April, with the reopening of construction sites and gardening and home improvement stores, many other shops and particularly the food and catering sector remains stifled by the confinement measures imposed in Luxembourg on 16 March to curb the spread of coronavirus.

The announcement comes after the Chamber of Commerce conducted a survey of around 2,600 businesses which found businesses were running out cash and government aid was not enough.

“Strong sectoral measures are necessary, to take account of the specific needs of businesses depending on the duration, scale and impact of the decline in activity,” the chamber wrote in a statement accompanying the wish list.

The list was agreed during a plenary meeting of its 25 representative members on Thursday.

They include:

Measure 1: Provide for flexibility in short-time working and extend it until at least the end of 2020 or normal work activity resumes. Governments should Implement a ‘force majeure/coronavirus’ partial unemployment scheme with an accelerated procedure for all businesses that had to stop their activities completely or partially made it possible to support these businesses.

Measure 2: Reduce companies' fixed costs and support their cash flow. According to a Chamber of Commerce survey, half of the 2,525 companies surveyed will be liquidated as of 1 May. It therefore wants:

- aid beneficiaries to include young businesses and businesses in difficulty, which it believes are too often excluded;

- a reduction in rent during the period of closure of activities, state coverage of the social security charges on partial unemployment for businesses which, due to the impact of the crisis, will have to continue to use it;

- a reframing of the aid scheme for businesses in temporary financial difficulty, to focus more on grants rather than repayable advances;

- an extension of non-repayable direct aid of €5,000 and €12,500 to include the month of May; for businesses with more than 20 employees, the introduction of non-repayable direct aid corresponding to 50% of their fixed costs in April and May (aid extended, if necessary, for businesses impacted by the crisis in the following months);

- new direct non-repayable aid for the self-employed, more substantial than the €2,500 granted to them in the first phase.

Measure 3: Repay "repayable advances" only when there is a return to "better fortune". The chamber wants a two-year grace period to repay aid instead of one as is currently the case. It says that it is this fear of repayment that discourages certain businesses from using repayable aid.

It also requests that the ceiling of aid in Luxembourg be raised from €500,000 to €800,000. Teleworking should be maintained in companies where possible.

Measure 4: Consider the reopening of shops and restaurants that can implement the health restrictions and social distancing measures between clients. It recommends sector specific measures and an extension of measures with neighbouring countries regarding tax treaties.

Measure 5: Create an Economic Stabilisation Fund, like the German Wirtschaftsstabilisierungsfonds, which would repurchase corporate debts and bonds for Luxembourg, or even acquire holdings. The Chamber of Commerce recommends that state guarantees not be included in the fund, but to extend them until the end of 2021.

Measure 6: Set up a loss carry-back system for tax payments over two years in view of the non-negligible losses businesses are likely to incur.

Measure 7: Create a package aimed at supporting consumption in heavily affected Luxembourg sectors, for example, increasing the face value of meal vouchers through a public subsidy, provide vouchers for the non-food and hotel trade, a temporary drop in VAT from 17% to 15% during the period of the crisis, lower special rates of VAT applied in certain sectors (in particular in catering and hospitality), tax deductible donations, for example, to local shops, direct financial aid (non-refundable) for consumption by low-income households.

Measure 8: Exempt from employer contributions the 1st job created by a very small business (VSE) for 12 months to encourage them to hire and further expand.

Measure 9: Aligning the social security system for the self-employed with that for employees. It says that in some cases, the self-employed, or even the owner of a sole-proprietorship business, may find themselves in a critical situation in terms of income, especially during the launching phase of their activity, strongly impacting their financial situation, and social minimum wage allocations during the first 6 to 12 months of the activity could help the entrepreneur get started. Another immediate measure would be to extend the replacement income benefits to the self-employed who regularly contribute to social security.

Measure 10: Review bankruptcy proceedings through the creation of a liability administration for business leaders in cases of bankruptcy adapted to exceptional circumstances that do not deprive the honest business leader who had to file for bankruptcy of a real second chance (easing of the conditions for action regarding coverage of liabilities, easing of the manager's responsibility regarding the company's tax and social debts, easing of business authorisations in the event of first bankruptcy, etc.).

Measure 11: Creation of a "one-stop shop for SMEs", with a single contact for back-office dispatching. It would gather in one single point useful and relevant information for the business and give direct access to the various administrations (social security, authorisation for establishment, the Agency for the Development of Employment, VAT, direct taxes, state aid) via a direct line (physical or virtual). This one-stop shop would make it possible to inform each company on administrative topics, but also to direct it towards partners, aid, and information (such as its eligibility for aid) related to its specific situation.