On Wednesday, the CSSF issued two papers in French, warning the public about “substantial risks linked to” virtual currencies (pdf) and ICOs (pdf), used to launch new virtual currencies through tokens.

On the former, the warning highlighted the risk of volatility in the crypto market and of a bubble effect because the environment lacked transparency and monitoring. It warned of the absence of protection and risk of theft because cryptocurrency exchange platforms may be vulnerable to hackers. Furthermore, information in the public arena about cryptocurrencies was “often incomplete, difficult to understand or does not reflect the risks of cryptocurrencies”. Furthermore, it said there was a risk of price manipulation because of a lack of transparency concerning user fees.

Such investments should not be considered for long-term projects such as retirement funds, the CSSF said. And it reminded investors that the absence of regulation means that cryptocurrencies could be used in illegal activities such as ransomware, money laundering or financing terrorism.

The CSSF’s warning about ICOs is similar to that related to cryptocurrencies, noting that a lack of verifiable information on the amount of tokens created, the money collected and evolution of rights associated with tokens, means the person acquiring the token has little idea as to its value or liquidity. It further added that the technology used to create coins, transfer and conserve tokens is so innovative it could be vulnerable to attacks, posing a risk to investors.

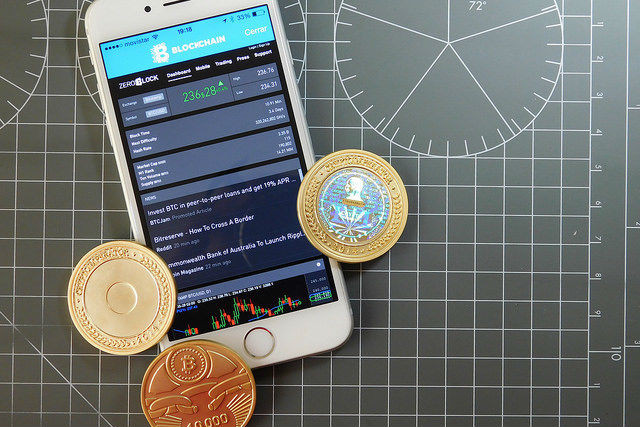

Blockchain technology

In both papers, the CSSF underlined that its warnings did not concern the blockchain technology used by cryptocurrencies, which it said “could bring certain advantages in their use in the financial sector and in different innovative projects.”

With regard to cryptocurrencies, the CSSF said it supported a European or even international level approach to create a legal framework, analyse impacts on financial stability, protect investors and prevent of exploitation of cryptocurrencies for illegal activities.

Last week Reuters reported reported US financial regulator the Securities and Exchange Commission as saying that online platforms that trade in cryptocurrencies--such as bitcoin, Ethereum and Ripple--should be subject to registration and government rules.