“I understood that what I wanted was to find a solution!” In August 2015, Rajiv Abrol, known as “Raj”, left KPMG--where he was an associate director in charge of helping his insurer clients to establish development strategies--to found his startup.

The consultant, who started out at the National Australia Bank then was at Accenture, identified a problem: no tool offers the capability of finding all information about a given company in real time. He launched Galytix, which mixes machine learning and artificial intelligence, to run two platforms, Index and Quont. What he calls “smart data analytics”.

Five years later, the British startup, spotted by PWC Luxembourg, raised €2m and recruited Massimo Arnoldi (founder and CEO of Lifeware) and Marc Nourse (former Big Four partner and head of strategy at IAG in Asia) to its board of directors, Gaëlle Olivier Triomphe (director of Danone and Axa) as advisor, and Keith O’Donnell (Atoz) and Ravi Venisetti (Chubb) to its supervisory board.

Second fundraising in early July

The young entrepreneur ticks most of the ten boxes of the ideal candidate for a fundraising round. Except that Abrol is not looking for money at the moment. The Australian has just completed a second round in early July to finance the company’s growth, increase in its workforce from 27 to 40 people and for commercial development.

Objective: to convince 20 tier 1 customers from the financial industry or the insurance world, capable of paying €4m to €5m for the solution. “We want to reach €100m in turnover within five years,” he said during an interview.

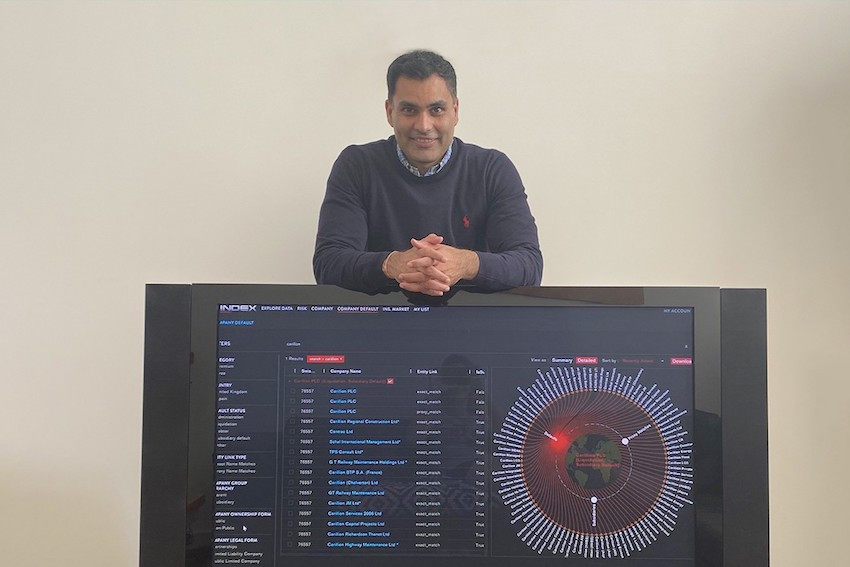

The demo is impressive, both in terms of information and ergonomics. The core of the system is run out of London, but the solution is adapted to the customer’s environment to allow it to bring it into line with its own tools and parameters.

“Something to gain in simplicity and efficiency,” says PWC partner Matt Moran, who has been mentoring the young prodigy--“a changer game changer”, he said--for a year. Data is protected in silos and Galytix does not have access to its customers’ IT environments, to preserve the confidentiality of data that the sector requires vis-à-vis regulators.

The Galytix Data Exchange will be able to produce information that insurers, bankers and regulators, or even investors, are looking for. Screenshot: Galytix website

How does it work? Its solution “will fetch the data that exists, whether it comes from official sources or the media, for example, ‘translate’ it in order to be able to harmonise and process it, configure it [editor’s note: depending on the trust placed in the source], analyse it and allow everyone to view it,” Abrol said during a joint interview with Moran.

Flipping the formula

Neither of the two wants to admit it, but technology can potentially replace dozens of consultants in audit firms and IT specialists in lighter structures. “Today, 80% of the effort is put into gathering information and 20% into analysis and ‘insights’”, they repeat almost in unison. “Tomorrow it will be the exact opposite. But humans will still have a role to play”, especially in qualifying the information.

When people talk about data as the new oil, the matters highlighted by Galytix are at the heart of tomorrow’s economic competition. An insurer would instantly know what the risk is of covering such and such a company, depending on its financial situation, compared to a sector benchmark or compared to its past. A banker would know directly whether he had an interest in supporting a business financially or what he should require from them to do so. The faster each of them is able to deliver their verdict, the more each gains.

Even a regulator would have an ideal tool for speeding up its supervision, given that links are established between companies, their subsidiaries and branches, and their managers, regardless of the jurisdictions to which they are linked. Because Abrol directly imagined the globality of the startup’s tools.

And he is working to establish a European hub. In Luxembourg. To get around Brexit.

Originally reported for Paperjam and translated for Delano