Switzerland is number one, followed by the USA and Cayman Islands.

The Financial Secrecy Index ranks jurisdictions according to their secrecy and the scale of their offshore financial activities.

Published on 30 January 2018, it “is founded on published, independently verifiable data. In contrast to some so called ‘blacklists’ of tax havens, inclusion in the FSI is not based on political decision making.”

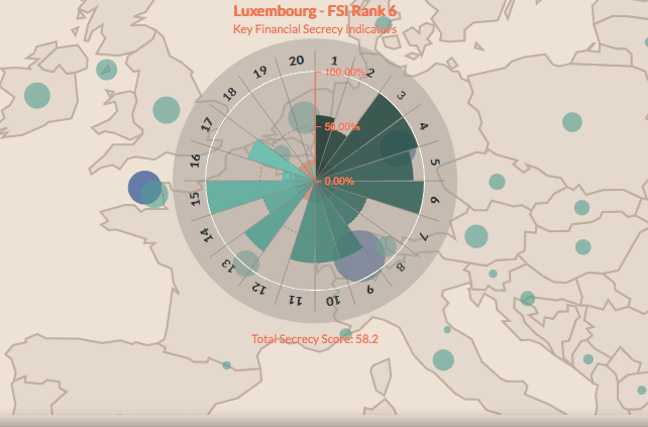

Countries are assessed against criteria which include whether companies, trusts and foundations are required to reveal their true owners, whether annual accounts are made available online in open data format, or the extent to which jurisdictions’ rules comply with anti-money laundering standards (FATF’s 40 recommendations). A total of 20 Key financial secrecy indicators (see below) is used for the measurement of the secrecy score.

Luxembourg

Its rank “is based on a moderate secrecy score of 58 and a very large share of the market for offshore financial services, at over 12 percent of the global total. Its position is largely unchanged since our 2015 index.”

The index states that its enormous financial sector has achieved “a strong degree of ‘capture’ over the political system, media and culture. Criticism of the finance sector, and discussion about its relationship to society, used to be exceedingly rare, though the LuxLeaks revelations in 2014 are helping to change this.”

Luxembourg scored better on buying citizenship, availability of public statistics, bilateral treaties and international cooperation. But it scored worse on recorded company ownership, other wealth ownership such as real estate and valuable assets stored in freeports, limited partnership transparency, public company ownership, and harmful structures in its legal and regulatory framework.

Find the comprehensive report on Luxembourg here.

Key financial secrecy indicators

- Banking secrecy: Does the jurisdiction provide banking secrecy?

- Trust and foundation register: Does the jurisdiction have a central register of trusts and foundations which is publicly accessible?

- Recorded company ownership: Does the jurisdiction require non-listed companies to submit information on beneficial and legal ownership?

- Other wealth ownership: Does the jurisdiction have ownership transparency of real estate and of valuable assets stored in freeports?

- Limited partnership transparency: Does the jurisdiction have transparency of limited partnerships (ownership and annual accounts?)

- Public company ownership: Does the jurisdiction require limited liability companies to publish beneficial ownership info on public records?

- Public company accounts: Does the jurisdiction require limited liability companies to file and make public annual accounts?

- Country-by-country reporting: Does the jurisdiction require companies to publish financial reporting data on a country-by-country reporting basis?

- Corporate tax disclosure: Does the jurisdiction publish all unilateral cross-border tax rulings, and ensure access to BEPS Action 13 CBCRs?

- Legal entity identifier: Does the jurisdiction requires domestic legal entities to use the legal entity identifier (LEI)?

- Tax administration capacity: Does the tax administration have adequate capacity to investigate and ultimately tax people and companies?

- Consistent personal income tax: Does the jurisdiction have a consistent Personal Income Tax regime? Does it allow buying citizenship?

- Avoids promoting tax evasion: Does the jurisdiction avoid promoting tax evasion on worldwide capital income on interest and dividends?

- Tax court secrecy: Does the jurisdiction have transparency in its judicial system in tax matters?

- Harmful structures: Does the jurisdiction have harmful instruments and structures within its legal and regulatory framework?

- Public statistics: Does the jurisdiction makes statistics on finance, trade, investments and taxes publicly available?

- Anti-money laundering: Does the jurisdiction meet the anti-money laundering recommendations of FATF?

- Automatic information exchange: Does the jurisdiction participate in international cooperation on automatic information exchange for tax purposes?

- Bilateral treaties: Does the jurisdiction have bilateral treaties for exchange of information exchange in place?

- International legal cooperation: Does the jurisdiction participate in international transparency commitments and cooperation on money laundering and crime?