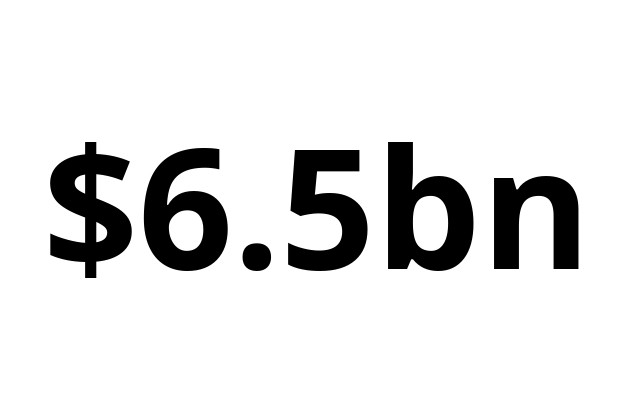

Investors in Luxembourg sold a net $6.5bn in US bills, bonds and notes, with total holdings of $223.7bn as of 30 April, official figures showed. Although that is still higher than the $213.8bn in holdings recorded in April 2018, the number had been above $220bn since June 2018.

At the end of April 2019, the grand duchy was the 7th largest foreign holder of US treasury securities. Mainland China was the biggest, with $1.13trn, but that was down by $7.5bn in April (which was already down by $10.4bn in March). The UK’s net holdings dropped by $16.3bn to $300.8bn.

Other “noteworthy” declines were recorded in Belgium, Ireland and the Cayman Islands, according to John Velis of BNY Mellon. He wrote on the bank’s The Aerial View blog on Monday:

“These are all locales in which pooled investment products are officially domiciled (as is the United Kingdom, another large fund center), so we would chalk up the decline in all of these jurisdictions to market conditions more so than any overt reserve management policies.”

The data was released by the US Department of the Treasury and Federal Reserve Board on 17 June 2019.