“It is the asymmetry of power in the relationship of men and women that is in all society, our entire world,” he said at the start. “Sexual violence is only one aspect of it.”

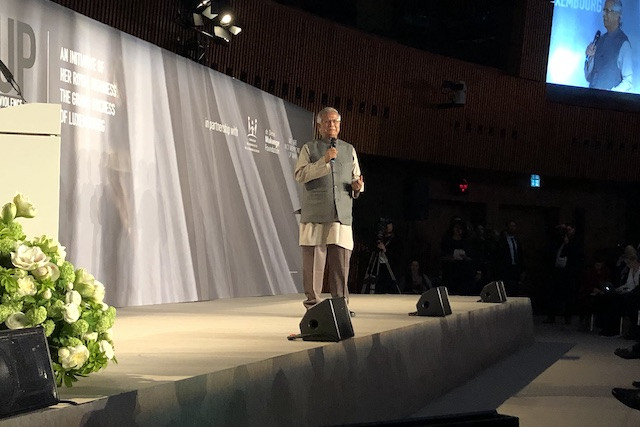

Yunus, founder of Grameen Bank--considered to be the first microcredit institution--has seen this asymmetry personally after he accidentally got involved in lending which then became lifelong learning for him. He described to the audience the history of Bangladesh’s independence in 1971 and how during the process “many rapes took place…children were born out of this victimisation, that’s the beginning of our history.”

He quit his teaching job in the US to head back to Bangladesh, that “new nation waiting”, saying he had lost all faith in economics, the subject he had been teaching. Getting to know villagers, he was stunned to see so many victimised by loan sharks, so he asked himself how he could protect even one person or more from that. So he began lending.

Early on, he decided he wanted to have a 50% ratio of women in the programme. “It raised a lot of controversy right from the beginning,” he said. Not only were banks not lending to people without money, they weren’t even lending to women who were well-to-do.

Although he couldn’t approach women at that time due to religious reasons, he sent his female students to do so. What surprised him was that the women first responded that they were afraid to handle money. “Always remember this is not her voice. This is the voice of the history which made her…she is surrounded by layers and layers of fear,” Yunus told his students. “Our job is to go back to her again and again, quietly and sympathetically, and try to peel away the fear, layer after layer, hoping that one day, one of them [would] say, maybe I should try.” Yunus knew if one woman was successful, others would take notice. Six years later, he had reached the 50% female ratio he had aimed for (today it’s 97%).

“The relationship between men and women changed completely in the family,” Yunus said. “With each loan, her position moved up, and the gap between the two grew closer and closer.”

In 2008, Grameen America set up its first bank in Queens. Now it has seven branches in New York City, part of 25 across the United States. 10 years and over $1bn later, the bank boasts a recovery record of over 99%. Yunus added: “And 60% of these borrowers are undocumented women. Imagine, in Trump’s world…”

Yunus, who received a standing ovation at the end of his speech, urged participants to question why institutions are the way the are, and to create new roads in order to reach new destinations. “We’re not money-making robots,” he said on Wednesday. “We need to rediscover ourselves, not be based on greed.”