Presenting the findings of the third economic barometer survey conducted since the start of the health crisis, chamber of commerce director Carlo Thelen on Wednesday explained that 36% of companies with six or more employees cut their training budgets from 2019 to 2020.

Training cutbacks were most acute in the catering and hotel sector, horeca (47%), non-finance services (40%), construction (39%) and trade (38%). Staff training in industry and transport sectors remained constant.

Over a third of companies polled said they were not aware of financial support for training, a rate that rose to 41% in small companies (with 6-9 staff). Company leaders called for greater financial aid to subsidise training, an improvement of the offer as well as an audit with companies to better understand their skills and training needs and establish a training plan.

On Wednesday, Thelen advocated for moving towards a skills-based recovery, be it digital, organisational, technical or leadership-related, and called for the state to help facilitate. “In the recovery, the state should support continuing education much more financially, for example by increasing the co-financing rate from 15 to 25%,” he said.

Other barometer findings

Some 628 companies with 6 or more employees participated in the survey during the first half of April. While their economic score rose from 46 to 54/100 since the last survey, it was still below the pre-crisis score of 62/100 recorded in 2019. Activity evolved in-line with business leader expectations, who were pessimistic in the last survey conducted at the end of 2020. The decline was more subtle than over the spring and summer of 2020, but marked a third consecutive decline for companies.

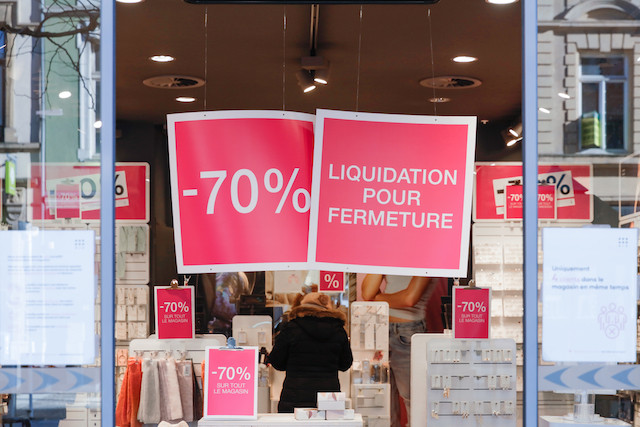

Financial services firms were the only ones to have grown, while declines were recorded in construction (-13%), non-financial services (-16%), industry (-18%), trade (-21%), transport (-40%) and horeca (-88%).

Expectations for the coming months

Business leaders expected a slight improvement over the next six months, with 32% of companies forecasting an increase in activity, compared to a decrease for 18% of leaders polled.

Profitability difficulties encountered by companies are having an impact on their ability to access credit. In all 22% of companies have encountered difficulties in accessing credit over the past 12 months including 47% in horeca, 24% in trade and 23% in construction. This percentage was only 12% for all companies in the first edition of the barometer, in June 2019.

Employment silver lining

Almost a quarter of companies are expected to increase their workforce in the coming months, compared to 15% for whom the number of jobs is expected to fall. Unemployment rose sharply during the crisis, reaching 6.9% in the second quarter of 2020, but since fell to 6.1% in March 2021.

Government furlough schemes, which have thus far paid out €463 million, are largely responsible for stabilizing the rate. Thelen called on the government to maintain these partial employment measures in worst affected sectors like horeca and trade for as long as possible. He said: “They will also allow companies to have the cash flow essential to the recovery of their activity. This is why their withdrawal should be gradual.”