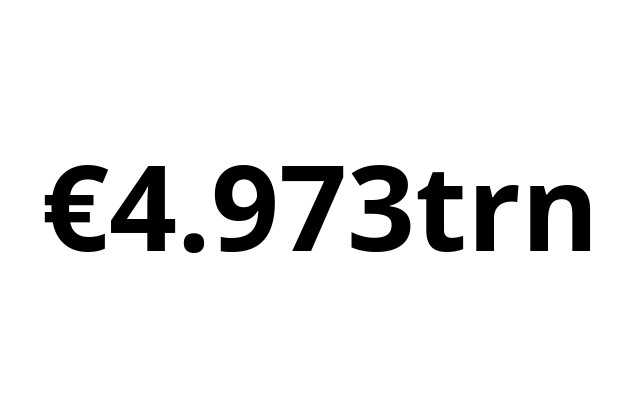

With €4.973trn in AUM distributed among UCITS funds, specialised funds and Sicars, the Luxembourg fund industry will have experienced growth over the year of 5.40%, according to the latest figures from financial centre watchdog CSSF. It will also have erased the losses recorded during the first lockdown. In March 2020, assets had declined 11.11% over one month. But despite the dip at the start of the year, the financial industry has proven “resilient”, LFF CEO Nicolas Mackel said in a statement, “in large part due to the extraordinary support measures governments and central banks made available to our economies. It is also due to the regulatory measures adopted after the last crisis.”

Some 500 promoters in the grand duchy have set up over 3,600 funds sold to investors in 77 jurisdictions, contributing to Luxembourg’s position as globally the most widely distributed for such investment vehicles and second largest fund domicile location worldwide.

Brexit, covid-19 impact

Over the course of 2020, 82 new entities were licenced to operate. Five new banks set up activities in the grand duchy, including Goldman Sachs Bank Europe branching into Luxembourg as part of its post-Brexit strategy.

“2020 was also about Brexit, although most financial firms were already well prepared from an operational perspective,” Mackel added. “While financial services is not covered by the trade agreement announced on Christmas Eve, the mere fact there was a deal is essential for other issues directly affecting the sector, such as the granting of equivalences.”

The agency also said that while insurance premiums struggled as a result of covid-19--mainly due to the 33.99% decline in the life insurance sector--the health crisis had spurred digital payments and has taken sustainable finance front and centre, with the €17bn EU Sure bond being 17 times oversubscribed and the Luxembourg Stock Exchange boasting 407 new sustainable securities totalling €186bn.