The company is expected to go public by the end of the year. In January, the company's market capitalization for its private business was estimated at $47 billion. It is now reportedly being valued somewhere in the $10 to $12 billion range.

WeWork’s high valuation, steep losses, and frosty reception by investors are all contributing factors to the delay. Investors are concerned about the feasibility of the company’s coworking space business model which includes buying and renting buildings, turning them into shared office spaces, and then renting out space and amenities for a subscription fee.

Many investors are concerned how the combination of long-term liabilities, in the form of buying and renting real estate, and short-term revenue from the subscriptions can withstand economic downturns.

The company’s net losses are steep compared to its revenue, a theme in high-profile IPOs this year. Earlier in 2019, Uber went public, raising $8.1 billion. In its most recent quarter, the ride sharing company posted net losses of $5.2 billion.

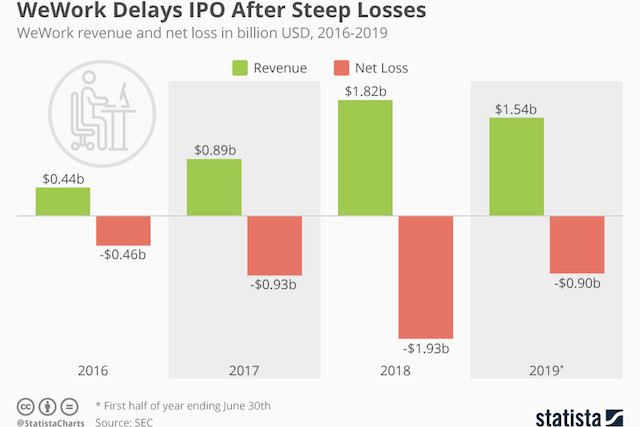

The SEC filings revealed that WeWork recorded a $900 million loss on $1.54 billion in revenue, during the first half of 2019. Year-over-year revenue doubled, while losses increased by 25 percent. In 2016 the company’s net losses were practically on-par with its revenue.