That’s according to Capgemini’s latest World Wealth Report published on 9 July.

Before you break your piggybank to make a charitable donation for millionaires in need, be informed that the decline can largely be attributed to the ultra-rich, i.e. the top 1 percent of the world’s high-net-worth population, who accounted for 75 percent of the total decline in global millionaire wealth.

Meanwhile the millionaire-next-door segment ($1 to $5 million of wealth – Capgemini’s terminology, not mine) only suffered a 0.5 percent dip in collective wealth.

According to Capgemini’s estimates, the Asia-Pacific region suffered the biggest declines, with China’s millionaires alone losing more than $500 billion in collective wealth. The Chinese stock market suffered a 20 percent decline in 2018, as measured by the SZSE Composite Index, as trade tensions and fears of a broader economic slowdown dampened the mood in what had looked like an emerging giant in recent years.

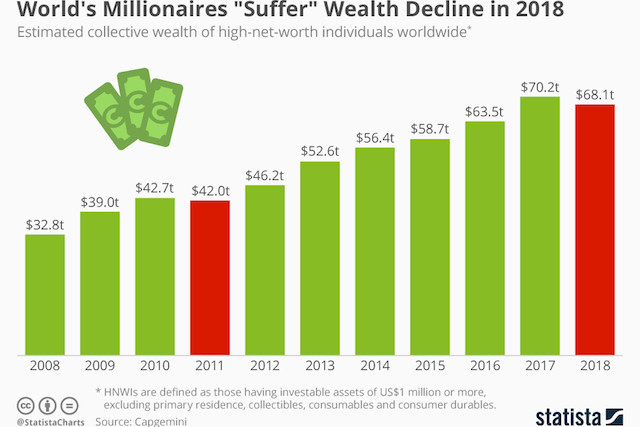

While the collective wealth of the world’s millionaires declined by 3 percent in 2018, the global HNWI population remained nearly steady (-0.3 percent) at 18 million.

The United States still has by far the largest population of millionaires (5.3 million), with Japan, Germany and China next down the list. Combined, these four countries accounted for 61 percent of the global HNWI population in 2018.